IRS Complaint Filed Against Summerfest

Complaint challenges festival’s nonprofit status, claiming it now operates ‘as a commercial entity.’

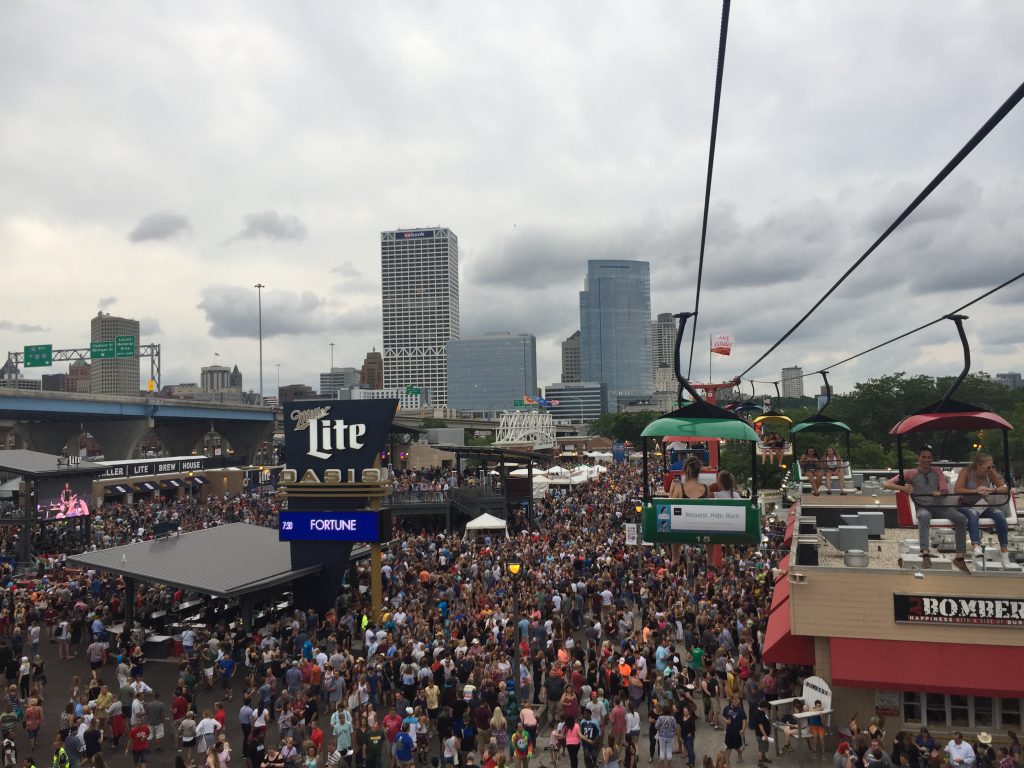

A complaint has been filed with the federal IRS against Milwaukee World Festival, Inc. (MWF) the nonprofit entity that operates Summerfest, charging that the organization “has significantly diverged from its non-profit mission” and now operates “as a commercial entity” that “directly competes with for-profit firms in the Milwaukee area” and “leverages its tax-exempt status to engage in anti-competitive behavior.”

He called it a “strong” complaint, based on a pattern of activities by Summerfest’s parent organization. The complaint charges that:

-“MWF directly and vigorously competes with for-profit firms in the Milwaukee area,” using “its tax-advantaged position and its ability to solicit tax-deductible donations from the public” to position itself “as the biggest player in the Milwaukee concert venue and promotion market.”

-MWF requires performers to agree to contractual provisions” to not perform elsewhere in the Milwaukee area for up to six months prior to Summerfest, which given the size of the Milwaukee market effectively means “any performer that MWF books is unlikely to play any other venue in Milwaukee that same year.”

-“Since at least 2019, Frank Productions Company Live (“FPCL”) has operated as MWF’s exclusive promoter for its American Family Insurance Amphitheater and the BMO Harris Pavilion. LiveNation, one of the worlds’ largest live music event promoters, owns a controlling interest in FPCL.” They pay “50% to 100% above market rate for acts to perform at Summerfest.”

-MWF will be leasing its land in the Third Ward to an entity that will allow Frank Productions and Live Nation to create two new for-profit venues with a capacity of 4,000 and 800, which can also be down-scaled to create more intimate concerts. Together with the two huge Summerfest stages programmed by Frank productions, the four venues would be capable of handling “crowds of as few as 100 and as many as 23,000” and thereby “control talent from its inception, playing in coffee shop back rooms, until it matures to marquee venues for crowds in excess of 23,000. The entire arrangement is designed to stifle competition and seize market control from Milwaukee’s other for-profit promoters and venues.”

-“MWF uses commercial methods to promote its goods and services,” spending $2 million on advertising in 2019. Summerfest’s “smile” logo, the Big Gig, and The World’s Largest Music Festival are all “registered trademarks or tradenames of MWF” and may not be used without its written permission.

The complaint quoted liberally from past Urban Milwaukee stories about Summerfest, noting that MWF pays salaries that are more like those in the for-profit sector. MWF president Don Smiley “earned $971,000 in 2017, while attendance at Summerfest was 831,769, meaning the equivalent of $1.17 of every ticket went to compensate the organization’s president,” the complaint noted.

“From 2016 through 2020, Smiley was paid a total of $6,369,091.00 according to MWF’s tax filings, an average of over $1.2 million per year… This compensation appears to be far more than other non-profit directors with similar responsibilities. For example, the director of the Wisconsin State Fair is paid a comparatively-scant $140,310 salary.” The complaint noted that in an interview with Urban Milwaukee, MWF Board Chair Howard Sosoff said MWF considers itself “a private corporation” and determines the compensation for Smiley based on comparisons to executives at for-profit companies.

All told, the complaint reads like a music industry’s take on how music booking works in Milwaukee.

MWF’s agreement to lease land it owns to for-profit venues that would compete with established entities like The Rave and Turner Hall have created controversy, as Urban Milwaukee has reported. Pabst Theater Group President & CEO Gary Witt, whose five venues include Turner Hall, offered this response to the IRS complaint: “If Summerfest is misusing its non-profit status, it would allow them to unjustly increase their profits at the expense of other tax-paying businesses and give them an unfair competitive advantage with their current relationship with the largest mega-corporate concert promoter and owner of Ticketmaster, Live Nation.”

Rave co-owner Leslie West did not reply to requests for comment from Urban Milwaukee. Nor did Milwaukee World Festival reply to repeated requests for comment.

The IRS invites people to make complaints like this one. “Go ahead and complain,” its public release urges. “The Internal Revenue Service (IRS) is all ears – particularly about complaints alleging any abuse of the tax-exempt status granted to a non-profit organization.”

Board Source, which advises nonprofits, notes that “IRS auditors investigate the financial affairs of thousands of nonprofits each year. As a result, a handful of organizations have their tax-exempt status revoked; others pay fines and taxes.” Which suggests the odds of a complaint succeeding are low.

Is it possible the complaint was inspired by a certain Milwaukee alderman? Back in January, when Urban Milwaukee reported on the $2.49 million in combined compensation Smiley was granted in 2019 and 2020, Ald. Bob Bauman criticized this as the “kind of corporate compensation that you find in private companies.”

“I hope somebody raises this issue with the IRS, as something it should investigate,” Bauman added.

Well, somebody has.

Update 3:55 p.m. March 30: The BizTimes has picked up this story, crediting Urban Milwaukee, and Milwaukee World Festival has now released a statement on the IRS complaint:

“Milwaukee World Festival, Inc. has operated for 54 years to fulfill the non-profit mission set forth in its Articles of Incorporation, which include the promotion of an understanding of different ethnic cultures and nationalities, and the provision of a showcase for performing arts. We are confident that our operations are in furtherance of that mission.

“The referral to the IRS mischaracterizes facts in a way that unfairly and inaccurately depicts how MWF operates. The IRS has previously examined MWF operations and found that MWF continues to qualify for exemption from federal income tax. The organization has not significantly changed its operations since the most recent review.

“If contacted by the IRS regarding this referral, we will, of course, cooperate and provide any additional information the IRS requests.”

Political Contributions Tracker

Displaying political contributions between people mentioned in this story. Learn more.

- November 15, 2015 - Robert Bauman received $50 from Gary Witt

- March 27, 2015 - Robert Bauman received $250 from Don Smiley

- February 17, 2015 - Robert Bauman received $100 from Gary Witt

- October 15, 2014 - Robert Bauman received $100 from Gary Witt

Murphy's Law

-

Top Health Care Exec Paid $25.7 Million

Dec 16th, 2025 by Bruce Murphy

Dec 16th, 2025 by Bruce Murphy

-

Milwaukee Mayor’s Power in Decline?

Dec 10th, 2025 by Bruce Murphy

Dec 10th, 2025 by Bruce Murphy

-

Total Cost of Foxconn Is Rising

Dec 8th, 2025 by Bruce Murphy

Dec 8th, 2025 by Bruce Murphy

I don’t often agree with Bob Bauman, but in this case I do. It’s about time someone brings MWF’s non-profit status to the attention of the IRS. I hope something actually comes of this!

Milwaukee World Festival is out of control. Throw the book at ‘em.

I’m good with this idea. While the IRS is looking at Summerfest, may as well look at the RW oligarchs at the Bradley Foundation as well.

Summerfest hid the ball when making the deal with FPC for their music venue. They assume the city, the Harbor Commission and the DNR will bow to their wishes. The 75 acres Summerfest uses is no longer the best, highest use of this land. Time to clip their antlers.

I am surprised that the Wisconsin Institute for Law and Liberty hadn’t filed a suit on this issue. Here is a entity authorized by Statute to compete with the private sector that operates like secretive for profit corporation protecting a monopoly for Live Nation and Frank Productions.

So the job pays roughly 2x the salary paid to the UW System President? This is nuts.

I’m amazed it’s a non profit! uh.. what?!