Watchdog Group Seeks Probe of Johnson Project

Did Walker administration pull strings to give senator’s children tax credits worth up to $2.1 million?

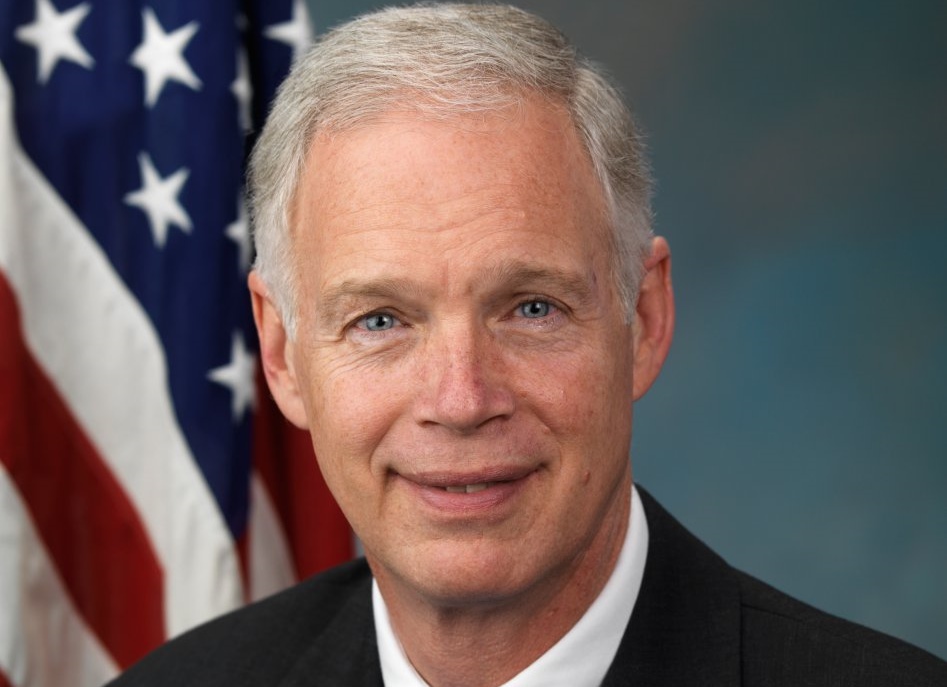

A Washington, D.C., government watchdog group is asking the state Ethics Commission to look into historic tax credits awarded to the children of Sen. Ron Johnson three years ago.

The ethics complaint that Campaign for Accountability (CfA) filed with the commission on Monday follows allegations made in August and September by the Congressional Integrity Project (CIP) that the tax credit applications were improperly fast tracked. CIP’s allegations were reported by Milwaukee Journal Sentinel columnist Daniel Bice.

CIP, which has been targeting Johnson with critical advertising, drew attention to its allegations of favoritism toward Johnson’s children after the senator released a report critical of Hunter Biden, the son of former Vice President Joe Biden, the 2020 Democratic presidential nominee. The report on Hunter Biden showed no wrongdoing, according to the Journal Sentinel.

Representatives of both the State Historic Preservation Office (SHPO) and the Wisconsin Economic Development Corp. (WEDC) have stated their agencies followed normal procedures and denied any favoritism in their handling of the project. Johnson’s office did not respond to requests for comment, but a spokesman told the Journal Sentinel in September that the allegations were “ridiculous.”

Both the Campaign for Accountability complaint and the Congressional Integrity Project’s allegations against Johnson focus on emails surrounding the approval of historic tax credits worth up to $2.1 million for Johnson’s three children, Ben Johnson, Jenna Golem and Carey Sharpe, in 2017, in the last two years of former Gov. Scott Walker’s administration.

Through a corporate entity, 405 Washington Ave. LLC, the three paid $350,000 to buy a building in their hometown of Oshkosh in 2017 that was formerly owned by the Eagles Club on May 31, 2017, according to the complaint. Five months later, on Nov. 1, 2017, they began the process of applying for tax credits on the project.

“The timing was important because in September 2017, then-Governor Scott Walker used a line item budget veto to strike ‘Wisconsin’s historic preservation tax credit program,’ reducing ‘the per-project cap from $5 million to $500,000,’” CfA observes in its complaint filed Monday. “The change was to go into effect on July 1, 2018, and would have significantly reduced the credits available to 405 Washington Ave. LLC.”

Standard procedure called for the application to go first to the Wisconsin State Historic Preservation Office (SHPO), but the email records show that Sharpe instead sent the application directly to a Wisconsin Economic Development Corp. regional manager, Jon Bartz, who subsequently forwarded it to the SHPO’s senior preservation architect, Mark Buechel.

The complaint questions the application’s divergence from standard procedure. It also points out that WEDC’s staff review claimed the project would lead to 30 full-time jobs, contradicting what Sharpe had told the WEDC’s Bartz. And the complaint observes that three top officials of the WEDC at the time, CEO Mark Hogan, board Chair Lisa Mauer, and Treasurer David J. Drury, were Johnson donors.

“The warm political relationship between Senator Johnson and WEDC’s CEO, its board chair and its treasurer seem relevant in light of the speed with which the Senator Johnson children’s application was processed, and the fact that the WEDC found a ‘strength’ of the children’s application was the non-existent job creation plan,” the complaint states.

The project received historic tax credits of $944,703 on Feb. 13, 2018, “less than five months before the historic tax credits cap was to be reduced,” the complaint states; their ultimate value could reach $2.1 million.

“Had WEDC followed its own policies and not felt obliged to ‘help out’ Senator Johnson’s children,” the complaint argues, the tax credits would have either not be awarded at all, or they would have been awarded after the program cut took effect, “significantly decreasing” their value.

The complaint argues that the ethics commission “should find there is a reasonable suspicion that a violation has occurred and authorize an investigation into which WEDC and SHPO officials were involved in these decisions, as well as whether there was any direct contact between Senator Johnson or any of his representatives and any member or employee of the WEDC or SHPO, and whether the historic tax credits were awarded to the Johnson children improperly.”

Kara O’Keeffe, a spokeswoman for SHPO, told the Wisconsin Examiner: “We will work with and respond to any inquiries we receive from the Ethics Commission.” In September, O’Keeffe told the Journal Sentinel: “This owner followed the same rules as every other owner who receives Historic Preservation Income Tax Credits.”

In the same article, Johnson spokesman Ben Voelkel stated, regarding the CIP’s allegations: “This is a ridiculous attempt to try and smear a small business dedicated to serving the Oshkosh community.”

Reprinted with permission of Wisconsin Examiner.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

Did I understand this article correctly that the children of Senator Johnson paid only $350,000 for this building in Oshkosh and have already claimed over $900,000 in tax credits with the potential additional tax credits possibly going up to over 2 million?

gjb,,

My understanding of this article is similar to yours. “Something is rotten in Denmark,; ” possibly .something is rotten some miles south of Denmark, WI.