Two New Financial Counseling Centers Open

Run by non-profits, offering financial and career counseling for lower income people.

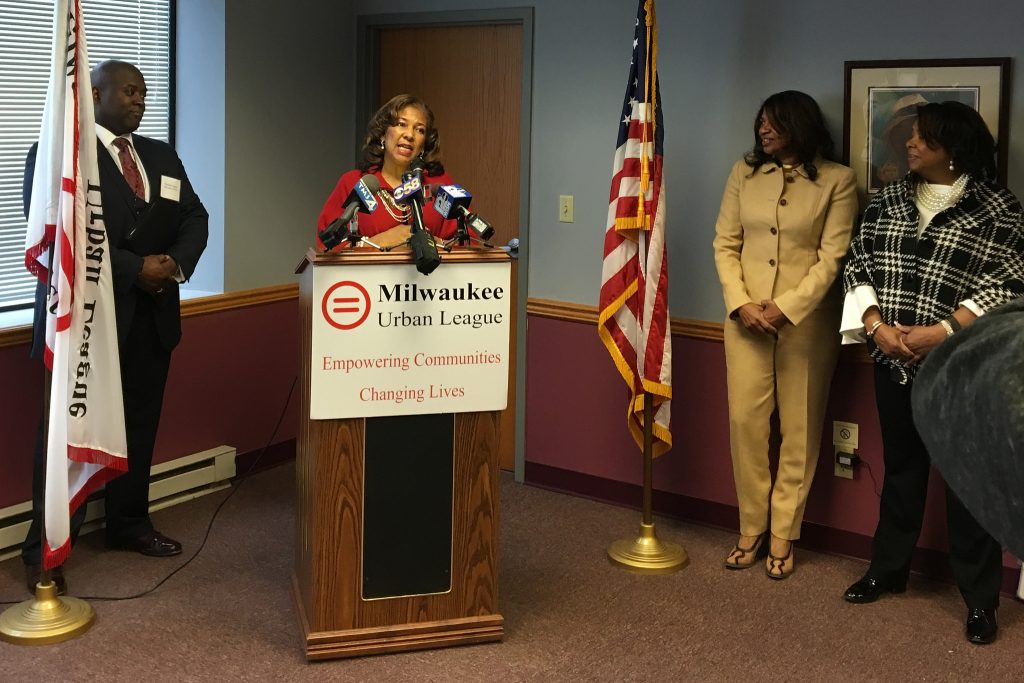

Eve Hall, president and CEO of Milwaukee Urban League, speaks at a ribbon-cutting ceremony for two new Financial Opportunity Centers. Photo by Rachel Kubik.

Two new Financial Opportunity Centers in Milwaukee, just opened Feb. 13, will help low- and moderate-income individuals build credit, savings and assets, among other services.

The new FOCs are operated by the Milwaukee Urban League at 435 W. North Ave. and Milwaukee JobsWork, at 2821 N. 4th St. Milwaukee LISC partnered with Milwaukee Urban League and Milwaukee JobsWork to establish the centers.

Two pre-existing FOCs are continuing to operate at Riverworks Center on the North Side and Journey House on the South Side.

The Riverworks Center and Journey House FOCs together have more than 500 clients per year who benefit from employment and career counseling, one-on-one financial coaching and low-cost financial products. Clients also can be connected with income supports such as food stamps, utilities assistance and affordable health insurance. The new FOCs are expected to serve at least 100 additional clients each year.

Eve Hall, president and CEO of Milwaukee Urban League, said she is excited that additional service and support will be available for people looking for jobs.

Michael Adams, the director of employee development at Milwaukee JobsWork, said LISC approached JobsWork to open an FOC because of its workforce model — providing clients with case management, counseling, comprehensive trainings and ultimately job placement.

Adams said the partnership will help JobsWork serve its clients in a more comprehensive way, adding that the community will see a model that’s been missing for quite some time.

Shaunta Gibbs has been a client of the Riverworks FOC for the past two years. Because of the help she’s received, her credit has improved from a score in the 300s to a score in the 600s.

Gibbs, 34, is also a first-time homeowner. “This was … a milestone that I wanted to have in my life done by a certain time and I was able to meet that goal … so I’m really excited about that,” Gibbs said.

The coach encouraged Gibbs to set financial goals, as well as short- and long-term life goals. “You can’t get yourself financially together if you’re not together, so you work on yourself and then you work on (finances), and (then) you work on both at the same time.”

Gibbs participated in scheduled monthly appointments, but voluntarily saw her coach weekly. Her coach would ask her whether she was sticking to her budget and if she had talked with her banker about refinancing. “She was just trying to make sure I’m on my square and I haven’t dropped the ball.”

Gibbs said having a coach was like having a big sister who wants to see her do well and be a productive citizen. She said she did all the work and put in the sweat. Her coach was there to “guide me and comfort me through all of it,” Gibbs said.

Sakuri Fears, who oversees financial income and wealth building programming at LISC, said financial coaching benefits more than the individual. “We know that once people have financial stability, they’re able to really invest in their communities in a number of different ways.”

Fears said LISC is looking to increase the number of people served by the FOCs, as well as build out the program to be deeper and more meaningful for people.

“Low- to moderate-income families, often times, their budget is very tight. The additional support, we believe, is going to be helpful,” Hall said.

She advised families in a difficult financial situation to seek out the Financial Opportunity Centers for guidance and support, and not to be discouraged. “There are organizations and people out there to help.”

This story was originally published by Milwaukee Neighborhood News Service, where you can find other stories reporting on eighteen city neighborhoods in Milwaukee.