Will Supreme Court Overrule Key Part of Obamacare?

Result could increase health care costs and number of uninsured in states like Wisconsin.

The major current challenge to the Affordable Care Act (ACA), often called Obamacare, is a case called King v. Burwell, on which the Supreme Court is expected to rule in late June. If the plaintiffs are successful federal tax credits would be available only in states establishing their own exchanges, and not in states, such as Wisconsin, that depend on the federal exchanges.

The most direct effect of a ruling against tax credits would be to take away the subsidy from roughly 200,000 Wisconsinites receiving them. Without the subsidy, the average monthly premium for those Wisconsinites would rise from about $125 to $440. It’s likely most of these recipients would decide they could not afford insurance without the subsidy, and many may decide to risk going without insurance. If the cost exceeds eight percent of their family income, the ACA would agree it was unaffordable and exempt them from the individual mandate.

Another group among those losing the subsidy may continue buying insurance because they have major health problems, for example those with a history of cancer or suffering from diabetes.

Private insurers could not turn them down, because the section of the ACA law banning the exemption of pre-existing conditions from coverage or denying coverage to people in poor health would remain in place. As a result, the pool of people with individual health insurance would become sicker and more expensive.

Higher premiums in states like Wisconsin would encourage those not presently receiving subsidies and currently healthy to drop their insurance, leading to ever higher premiums as insurers attempted to cope with an ever more expensive population. In the end, many insurance companies might decide to abandon Wisconsin entirely.

The legal argument against tax credits for policies purchased through the federal exchange is based on ambiguous language in the ACA. The section authorizing the credits refers to the state exchange. Was this deliberate or an oversight? Proponents of the challenge argue that it was deliberate—that it was meant as an incentive to encourage states to establish their own exchanges. But incentives only work if they are known. In refusing to set up a state exchange and forcing people off BadgerCare and onto the federal exchange did Governor Scott Walker know that he would be denying Wisconsin residents the benefits of the tax credits? That seems inconsistent with his statement at the time that there was little difference between the federal and state exchanges.

Although most observers think the court will uphold subsidies for those buying insurance through the federal exchange, the decision could go either way. It appears there are three sure votes against the subsidies, four in favor, and two (Roberts and Kennedy) who could go either way.

The decision will come as evidence for the ACA continues to pile up, both in terms of its reducing the number of people without insurance and its effects on costs.

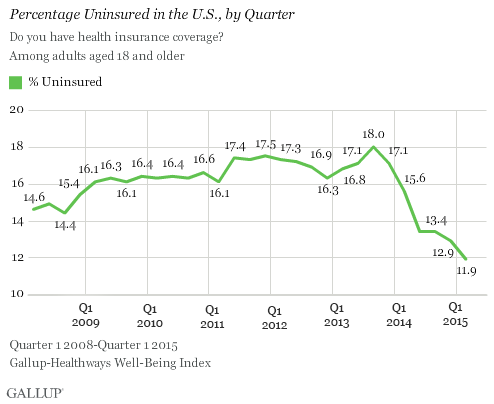

The latest polling from Gallup showed a continued decline in the percentage of Americans without health insurance in the first quarter of this year. As the chart to the right shows, the percentage of uninsured peaked in autumn of 2013, just before the ACA’s major provisions—the exchanges and the individual mandate—took effect, and has been plummeting ever since.

There is also evidence that health care costs, which have risen much faster than inflation for decades, are moderating. The Kaiser Family Foundation recently published a survey of the premiums for the 2nd lowest cost silver plan for a 40 year old man offered on the exchanges for the largest city in each state. The average premium is essentially flat for next year compared to this year.

Other evidence: The Kaiser Family Foundation’s survey of employee benefits includes estimates of the premiums for health plans offered by employers. It found them rising 3 percent between 2013 and 2014, much lower than in most previous years. Since the ACA was enacted the Congressional Budget Office has repeatedly lowered its estimates of future health care costs.

Even with these encouraging trends the total costs of healthcare are projected to rise in the future, and may continue rising faster than inflation. A key factor is the aging population, as the huge baby boomer generation retires and qualifies for Medicare. Life expectancies for people reaching age 65 are projected to continue to increase. As a result, even though each retiree’s Medicare costs have been flat recently, the total cost can be expected to increase.

Countries with universal health insurance, perhaps counter-intuitively, spend less on health care than the U.S. In the past insurers could prosper based on their ability to reject customers likely to incur higher costs. The recent decision to sell or close Assurant Health suggests this model is no longer a viable one. To the extent that the ACA has served to shift attention to making overall health care more cost-effective, it may have contributed to the recent moderation in costs.

A Supreme Court ruling that the tax credits are not available to residents of states using the federal exchange would have a disproportionate effect on states with Republican governors, like Wisconsin. Some of these states have been surprisingly sanguine about this possibility. Alabama, Georgia, Indiana, Nebraska, South Carolina, and West Virginia joined Oklahoma in an amici curiae brief supporting the argument against tax credits for their residents.

Recently, however, there has been a growing recognition among some Republicans that victory in this case could be a political disaster. Consider, for instance, a recent interview between Wisconsin Senator Ron Johnson and conservative talk show host Jay Weber (click here for audio). Weber started off by summarizing the political danger:

You have an op ed in the Wall Street Journal today about the GOP being prepared to react when and if a few million people can no longer afford their health insurance as a result of the King v Burwell ruling… A lot of conservatives think that that ruling, in our favor…will kill Obamacare. It doesn’t. And we’ll be under heavy pressure to roll over to the White House and quickly fix it and the White House is going to be proposing fixes that amount to passing a sentence or two of new legislation that closes up a few technicalities.

Johnson responds:

Yeah. Precisely. And unfortunately President Obama’s response to an adverse decision— in other words one that actually follows the law—will be really simple, just a one-sentence bill allowing ….. the federal exchanges and/or that offers the governors, hey, we know you got those federal exchanges, just sign the dotted line, make those established by the state.

Weber:

And of course, he’ll have the ads all racked up with the individuals that have benefited from Obamacare on the backs of the American taxpayer.

Johnson:

He’ll have all those examples as well, so —

Interjected Weber:

And the sad-sack stories about who’s dying from what and why they can’t get their coverage,

Johnson:

Right…

Overlooking the callousness of this discussion, Johnson has identified a real political problem. Enrollment through the federal exchanges is not limited to Democratic areas. People in heavily Republican counties would suffer. For example, 2,643 of the enrollees live in Waukesha ZIP codes, 1,977 in Brookfield, and 1,274 in Menomonee Falls. A court decision against the subsidies will likely make their insurance unaffordable.

To meet this political threat, Johnson introduced S.1016: A bill to preserve freedom and choice in health care. It is co-sponsored by 29 other Republican senators, including Mitch McConnell, the Republican leader. While the bill has no chance of surviving an Obama veto, it’s worth examining for the picture it offers of Republican thinking on health care policy.

At the same time it would allow the return of really bad insurance policies, ones that allow enrollees the illusion of being insured until they need health care. It leaves the definition of essential health benefits up to the states. Depending on the state, policies would not need include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance abuse, prescription drugs, rehabilitative services, laboratory services, preventive and wellness services and chronic disease management, and pediatric services, including oral and vision care, all of which are required by the ACA.

Perhaps most importantly, Johnson’s bill does nothing to address the likely death spiral of individual insurance in Wisconsin, as the pool becomes sicker and more expensive. If anything, it makes the spiral more certain. On the one hand, it makes it easier for people to go without insurance by dropping the individual and employer mandates. On the other, it does not touch the ban on excluding pre-existing conditions or taking into account an applicant’s health, making it more tempting for healthy people to forego insurance until they really need it.

Johnson’s bill does nothing in the long run for the “few million people” whom the Wall Street Journal predicts won’t be able to afford insurance if the Supreme Court rules adversely to Obamacare. Rather, the bill seems aimed at making the case that their plight is the fault of Obama and the Democrats, not the Republicans.

Data Wonk

-

Was Wisconsin’s Presidential Primary a ‘Huge Success’ For Trump?

Apr 10th, 2024 by Bruce Thompson

Apr 10th, 2024 by Bruce Thompson

-

Scott Walker’s Misleading Use of Job Data

Apr 3rd, 2024 by Bruce Thompson

Apr 3rd, 2024 by Bruce Thompson

-

How Partisan Divide on Education Hurts State

Mar 27th, 2024 by Bruce Thompson

Mar 27th, 2024 by Bruce Thompson

The consequences of a rushed through bill… yet the people who passed it won’t be the ones looking like the bad guys.

As the people that passed it, shouldn’t be looked at as the bad guys. Republicans haven’t come up with a plan where the math adds up or people don’t die from lack of coverage.

Guess they should have read the bill before they passed it. Tim, the republicans had many great ideas that Harry Reid would never allow to come up for a vote. This all falls on the backs of the democrats.

What were the many great ideas offered by Republicans? Now back to my grandma’s death panel.

Paul,

But why didn’t Johnson include those great ideas in his bill? It’s his bill, not Harry Reid’s. Seems like a missed opportunity.

PMD, TORT reform, letting small companies form a group to get insurance at a better rate and allowing people to shop across state lines.