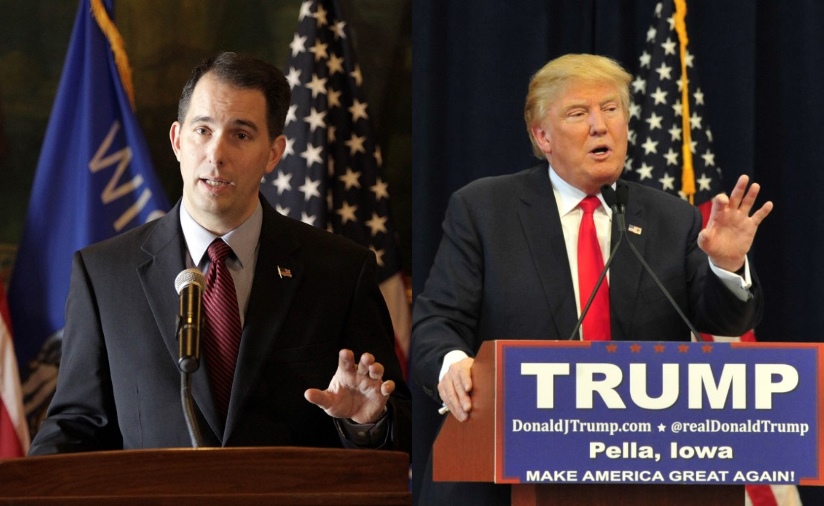

Walker and Forty-Fifth President Sweeten Deal for Foxconn

Taxpayers Need Real Details Regarding Administration’s Tax Plan

(MADISON) – Today, Vice President Mike Pence is in Wisconsin to talk tax reform with Governor Walker and local business leaders. However, early reviews of the administration’s plan to overhaul the tax code continue to be characterized as “lacking details” and a huge gift to corporations. Under the plan, corporations could see a new top rate of 20 percent, a move that may cost the government $1.8 trillion over a decade according to recent estimates.

On Tuesday, the New York Times reported that North Carolina offered $570 million, about a fifth of what Wisconsin’s GOP pushed to shell out, for the Foxconn deal. In response, State Senator Lena Taylor (D-Milwaukee) said “State lawmakers were hustled. We were repeatedly told that other states had made ‘better offers’ by the Governor and others supporting the Foxconn deal. Like some late night TV commercial, we were told that we needed to act fast or lose out. We have yet to see proof that any other state was willing to match the ridiculous agreement Governor Walker got us into with Foxconn.”

Senator Taylor also questioned how Foxconn’s near-zero income tax liability will interact with the administration’s tax plan. “Given that Foxconn will basically pay no corporate tax in the state, does the administration’s tax plan provide them with even more money over the life of this deal?”

In 2011, the federal Government Accountability Office reported that at least 60 percent of all U.S. companies – including many small ones – reported no federal income tax liability from 1998 to 2005. In 2017, a new report by the Institute on Taxation and Economic Policy found that 258 profitable Fortune 500 companies earning more than $3.8 trillion in profits paid no taxes in at least one year between 2008 and 2015. “I want Wisconsin and the country to be competitive in luring and retaining businesses, but I also think taxpayers deserve straight-forward answers, detailed plans, and a tax system that works for all of us, not just those at the top. Instead of simply being told to ‘believe me,’ Wisconsin residents need answers, and we deserve to see the President’s taxes so we know how he will personally benefit from his own tax plan.”

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

More about the Foxconn Facility

- Foxconn Paid Mount Pleasant $15 Million Make-Up Fee in 2025 - Steph Conquest-Ware - Jan 6th, 2026

- Murphy’s Law: Total Cost of Foxconn Is Rising - Bruce Murphy - Dec 8th, 2025

- WEDC, Foxconn announce additional $569 million investment in Racine County - Wisconsin Economic Development Corporation - Nov 25th, 2025

- Foxconn Acquires 20 More Acres in Mount Pleasant, But For What? - Joe Schulz - Jan 7th, 2025

- Murphy’s Law: What Are Foxconn’s Employees Doing? - Bruce Murphy - Dec 17th, 2024

- With 1,114 Employees, Foxconn Earns $9 Million in Tax Credits - Joe Schulz - Dec 13th, 2024

- Mount Pleasant, Racine in Legal Battle Over Water After Foxconn Failure - Evan Casey - Sep 18th, 2024

- Biden Hails ‘Transformative’ Microsoft Project in Mount Pleasant - Sophie Bolich - May 8th, 2024

- Microsoft’s Wisconsin Data Center Now A $3.3 Billion Project - Jeramey Jannene - May 8th, 2024

- We Energies Will Spend $335 Million on Microsoft Development - Evan Casey - Mar 6th, 2024

Read more about Foxconn Facility here

Mentioned in This Press Release

Recent Press Releases by State Sen. Lena Taylor

Taylor Statement on Off-Duty Officer Shooting

Jan 13th, 2022 by State Sen. Lena TaylorState Senator and Milwaukee Mayoral Candidate Lena Taylor statement