Ron Johnson, GOP Lawmakers Completely Abandon Wisconsinites With Reckless Vote Against Raising the Debt Ceiling

MADISON, Wis. — Last night, Ron Johnson continued his self-serving political games by leading his GOP colleagues to vote against temporarily suspending the debt ceiling, which could completely dismantle Wisconsin and the country’s economic recovery.

The consequences of Johnson and his GOP Colleagues reckless votes and efforts to not raise the debt ceiling could be felt by millions of Wisconsinites:

- Social Security: Over 1.2 million Wisconsin residents receive Social Security benefits. By refusing to raise the debt ceiling, Senate Republicans risk halting these payments and leaving Wisconsin’s financially vulnerable populations at high risk.

- Veterans: As of 2017, over 363,000 veterans live in Wisconsin, including 71,889 who receive disability compensation and 4,885 who receive pension. If the Senate GOP continues to play petty political games, the brave men and women who served our country and state could be at risk of a lapse in payments.

- Active Military: Wisconsin is home to over 1,000 active service members. If Republicans continue on their path to shutting down our government, they’ll take money out of the pockets of the brave Wisconsin service members who defend our country.

- Food Assistance Recipients: In Wisconsin, 312,579 households receive assistance from the Supplemental Nutrition Assistance Program. By voting against the debt ceiling, Senate Republicans are threatening to take food off the table from Wisconsin’s working families.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

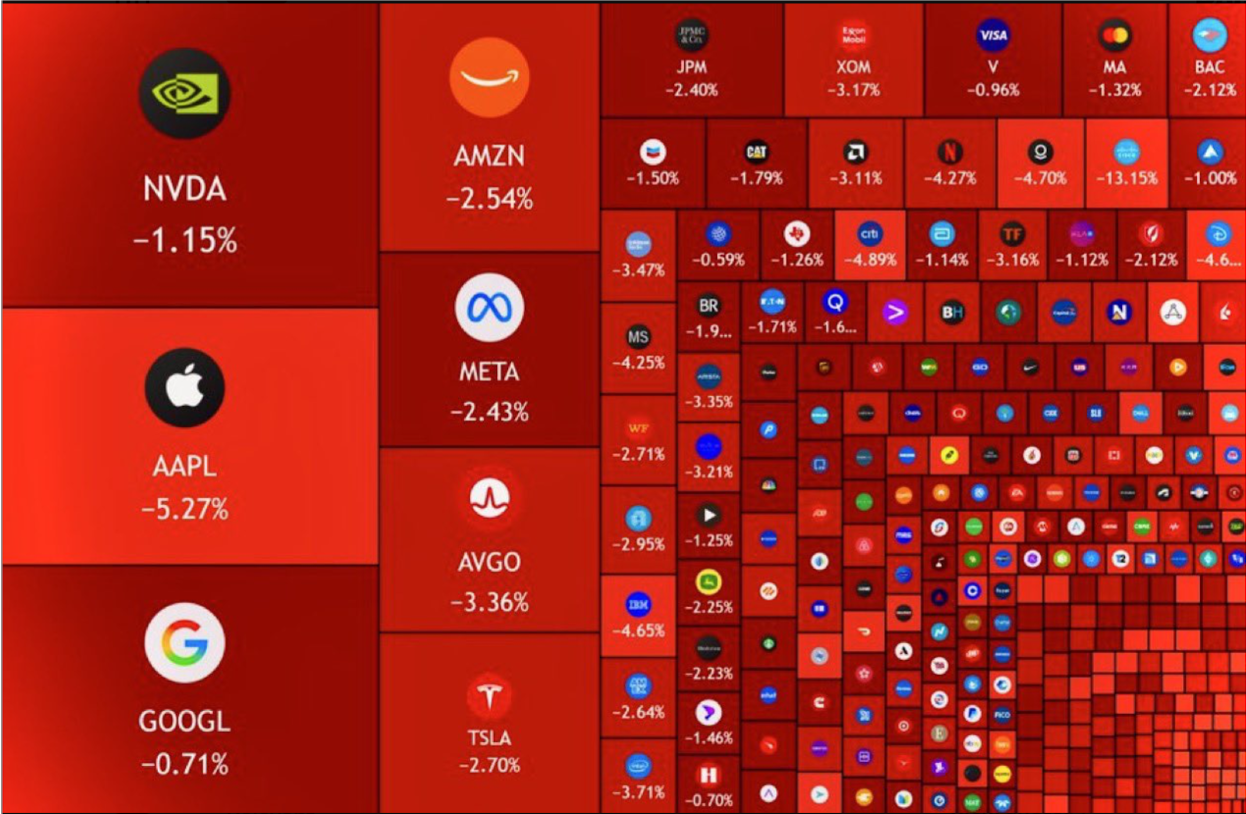

Defaulting on the National Debt puts everybody’s bank deposits as risk.

Even healthy banks don’t have enough cash if every depositor tries to withdraw their money at once. If people panic and start withdrawing their money en masse, FDIC insurance is what prevents a collapse. The FDIC’s only assets are Treasury securities. If the US defaults on its debt, the FDIC will have no assets to back bank deposits.