Farm Bankruptcies Rise in Wisconsin

Up 46% nationally in 2025; Wisconsin one of leaders in bankruptcy filings.

Snow melts on a corn field as temperatures rise Wednesday Feb. 11, 2026, in Verona, Wis. Angela Major/WPR

Farm bankruptcies are on the rise in Wisconsin, following a national trend.

A report from the American Farm Bureau Federation highlighted last year’s increase in Chapter 12 bankruptcies, a category of bankruptcy created specifically for farms and fisheries.

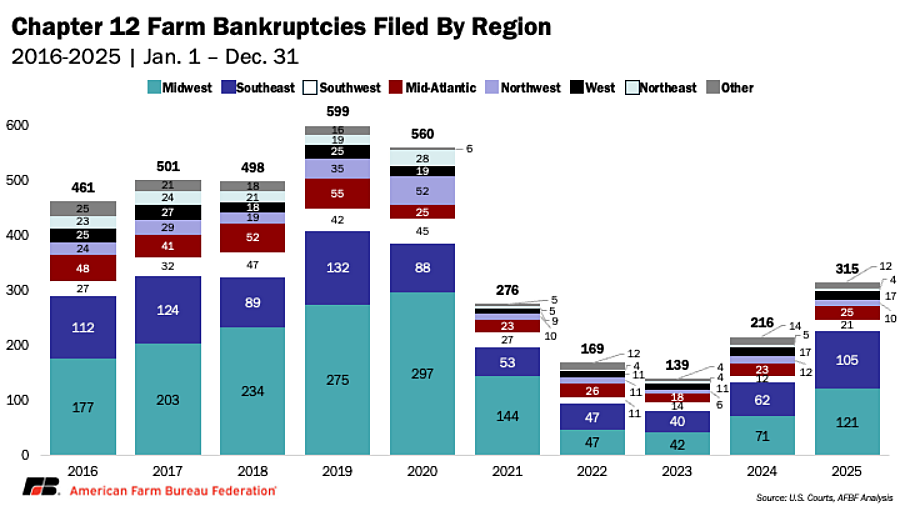

Bankruptcy filings were 46 percent higher than in 2024, according to the report, with more than a third of filings in the Midwest.

Graph shows farm bankruptcy filings increased in 2025 but remain below levels seen five to 10 years ago. Courtesy of the American Farm Bureau Federation

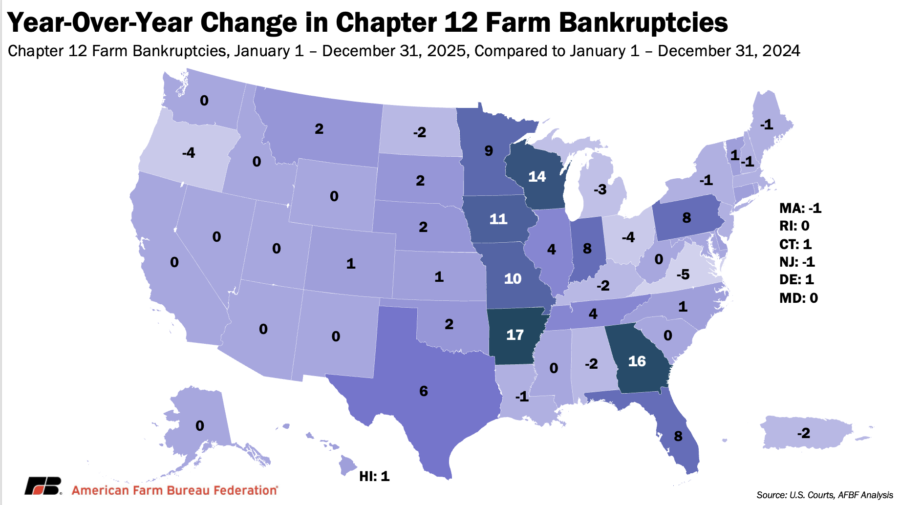

In Wisconsin, there were 16 bankruptcy filings in 2025. By comparison, there were two filings in both 2024 and in 2023.

Wisconsin led the nation in Chapter 12 bankruptcies as recently as 2022. But states like Arkansas, Nebraska and Iowa all surpassed Wisconsin in filings last year.

David Krekeler, bankruptcy attorney based in Madison, said bankruptcy filings are a “lagging indicator” of economic hardship. He said like most businesses, farmers will often max out loans, credit cards and even retirement savings before resorting to bankruptcy.

“It’s the rare case that somebody comes to me early,” said Krekeler, who has represented farms in bankruptcy court since the 1980s farm crisis. “They often wait until it is too late, when the options are very, very limited.”

Ag economist Paul Mitchell with the University of Wisconsin-Madison said milk prices declined last year, while corn and soybean prices have been down for several years. At the same time, producers are paying more for the labor and supplies they need to operate.

“That shows up as a low or a negative margin, where you’re spending more than you’re bringing in,” Mitchell said. “You can only do that for so long.”

Wisconsin saw one of the largest year-over-year increases in the country, in part because there were only two bankruptcy filings in all of 2024. Courtesy of the American Farm Bureau Federation

Mitchell said one thing that has allowed farmers to continue borrowing to stay in business is an increase in land values.

Wisconsin and other Midwest states have continued to see land values remain stable or increase slightly despite low crop prices. A recent survey by the Federal Reserve Bank of Chicago, which covers much of southern, central and eastern Wisconsin, found farm land values were up 9 percent at the start of 2026 compared to January 2025.

But Krekeler said he has seen higher land values get farmers into trouble by allowing them to borrow more than is wise.

The survey of ag lenders have also indicated farmers’ debt loads are increasing, with bankers reporting higher demand for loans and low rates of repayment.

Mitchell said inflation means farmers need to borrow more to plant crops or pay for necessary equipment, at the same time that interest rates have remained higher than just a few years ago.

“We were at really low levels, at 3 percent or 4 percent for some of these long-term loans. Now they’re paying over 7 percent,” Mitchell said. “They’ve got more money to borrow, and at much higher interest rate, it just gets to be financially very difficult for these farms.”

Chapter 12 filing numbers don’t capture all of the producers who are seeking relief from high debt levels through bankruptcy, according to Krekeler. He said in recent years, a majority of the farms he represents have used a different subchapter in the bankruptcy code that offers more favorable terms for small businesses.

Krekeler said he has seen a few more farms looking to file bankruptcy over the past year. But the number of producers continues to be small, in part because there are fewer farms in the state overall.

Farm bankruptcies tick up in Wisconsin, US was originally published by Wisconsin Public Radio.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.