Milwaukee Property Bills Bring Sticker Shock

But it's worth understanding what is causing bills to spike, and one opportunity to save.

Break out the gripes.

Milwaukee property owners began receiving their property tax bills in recent weeks. And for many, there has been sticker shock.

Turning to neighborhood Facebook groups, Next Door and other social media services shows plenty of people surprised to see a big increase.

“Do not open those envelopes before Christmas, it could be a nightmare, am not joking, am telling you in good faith,” wrote one member of Bay View Town Hall.

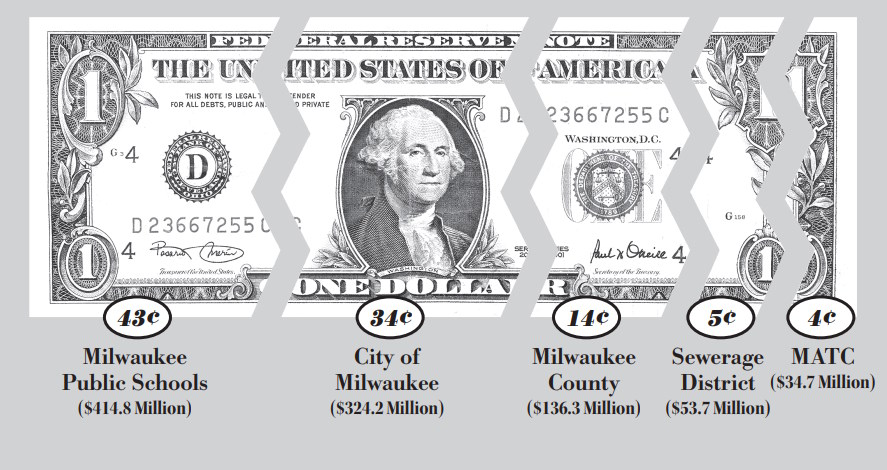

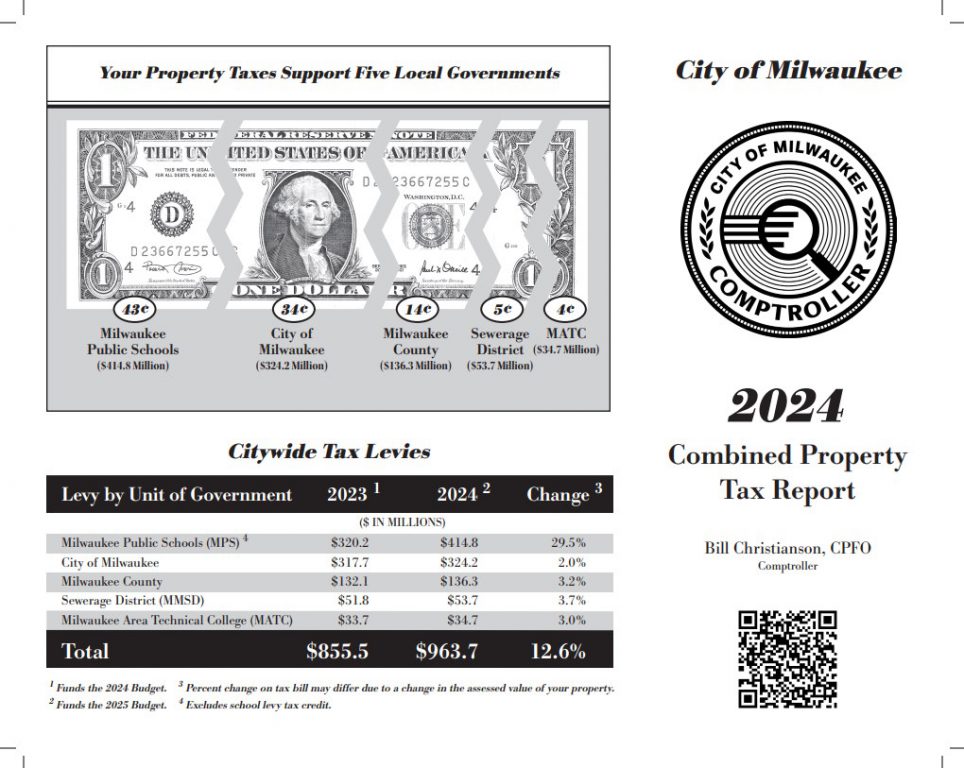

Despite the bill coming from the City of Milwaukee, it represents five bills in one: property tax levies from the city, Milwaukee Public Schools, Milwaukee County, Milwaukee Metropolitan Sewerage District and Milwaukee Area Technical College.

And only one of those entities had a referendum in 2024 that allowed its levy to exceed earlier levy limits: MPS.

The school district, after narrowly securing passage of a referendum in April and then seeing major financial reporting issues exposed in May, now sees its total property tax levy climbing 29.5%.

According to a report from the Comptroller’s Office, of every dollar collected from city property tax payments, MPS now accounts for 43 cents. The city receives 34 cents, Milwaukee County 14 cents, MMSD five cents and MATC four cents. In 2023, the city and MPS each netted 37 cents of every dollar.

State laws cap the amount of revenue a property taxing entity can collect, effectively restricting increases to small inflationary growth and the value of new construction. As a result, the other four entities saw their total levies rise between 2% (the city) to 3.7% (MMSD).

Factoring in the MPS referendum, the total amount levied grew 12.6%. A percentage that, all else being equal, would be passed onto every property tax owner.

But all else is never equal in a city with more than 150,000 properties. The separate assessment process, carried out in the spring, also influences bills.

Best described by Ald. Scott Spiker as a way to split a dinner bill fairly, the process aims to determine the fair market value of every property. It is later applied to the total tax levy, set by the annual budget process, to calculate how much of the total levy an individual property owner is liable for. Raising or lowering an assessment does not change how much money is collected in property tax revenue, but can change individual bills.

But a rising assessment doesn’t necessarily mean a rising property tax bill. If an individual property’s assessment increases less than the average, it often triggers a lower property tax bill. But, unless that gap was very large for your property, the MPS referendum likely rendered that possibility moot in 2024.

The MPS referendum passed 51%-49% in the April spring election, with approximately 81,500 votes cast. More than 4,000 voters, a figure more than twice the size of the final margin, cast a ballot in the April election but left the MPS referendum question blank. Far more voters showed up in November, with 249,007 votes cast in the presidential election.

The referendum allows MPS to have additional operating funds without an explicit requirement on what they are spent on. MPS and board members said the referendum was necessary due to the state underfunding of schools, with per-pupil aid not keeping pace with inflation.

But in May, just over a month after the referendum passed, Superintendent Keith P. Posley became the subject of intense scrutiny over long-delayed district financial reports to the state. He resigned in early June.

As reported in the lead-up to the referendum vote, the owner of a hypothetical $100,000 home was estimated to pay an additional $216 in the first year under the proposal. However, the median Milwaukee home is now assessed at approximately $166,000, rendering the increase even larger.

Make Sure To Claim This Credit

There is one surefire way to reduce the bill for your home: claim the Lottery and Gaming Credit.

If the property is your primary residence, you are likely eligible for the credit. But, in many cases, it is not automatically applied to your bill.

The state credit provides direct tax relief. According to the Wisconsin Department of Revenue, the average 2024 credit is $213. The agency provided guidance on claiming the credit in a press release.

If you think stories like this are important, become a member of Urban Milwaukee and help support real, independent journalism. Plus you get some cool added benefits.

Political Contributions Tracker

Displaying political contributions between people mentioned in this story. Learn more.

What happened to the cost of the voucher schools?

I’d like to know how much of my 21% increase is going to fill the hole left by Federal money for the Hop going away. Ya know, instead of filling potholes for the 99% of city residents who live and work far beyond that tiny circle of downtown.

I am settling an estate for my parents property in Milwaukee, and just saw the tax bill. For a 75 year old house that has been virtually untouched (meaning that the only improvements done on it in the last 55 years that they owned it was paint, a new furnace, and 2 roof replacements…it went up 27 percent! How the hell on God’s green earth can that be justified? I mean, over the years. it has already been going up every couple of years…so its not like they are playing catch up. My guess is that people are seriously going to be questioning if its worth living/staying in MKE land. Failing schools, crime, bad water pipes, and potholes every 10 feet (to name just a few problems) suggests that Mayor Duuufus doesn’t know what is important for the taxes that we pay. And please don’t tell me that it is the same everywhere. It just doesn’t seem to be worth it anymore for what we don’t get. Now excuse me while I go write ANOTHER check for the separate “fee” for street lights and snow removal that should already be on my tax bill, but for some reason, is an additional billing

DAGDAG We can thank Norq the Dork for that fee-that-isn’t-a-tax shafting. Johnny Zero relabeled certain items into “fees” so he could claim he was lowering – or at least not raising – property taxes. Adding insult to injury, fees are not deductible as SALT on our federal returns. Just more B/S from that Mequon-living hypocrite.

RetiredResident – Did anyone ever confirm or verify the Mequon conspiracy theory? Michael Horne called it an urban legend in 2015.

Also, almost nothing of your tax bill goes to the Hop.

The state basically, hasn’t provided any increased shared revenue to Milwaukee over the past 30 – 35 years, while Milwaukee has tripled the amount of shared revenue taxes to the state.

The police and fire departments’ overall costs look to be over half of the city budget, so there is not a lot left for other services. Oh yeah, most of the new sales tax increase is going to the Milwaukee Brewers owner for stadium upgrades. The stadium which is primarily used by non Milwaukee residents, who don’t have to pay anything for the stadium upgrades.

Who’s responsible for this graphic and breakdown in these letters? You’d think they’d have much more useful categories and not pit MPS against the city and county like that, wtf?

Good schools are important. But so is accountability and avoiding waste.

How can the school system justify paying former Superintendent Posley $160,000 severance and $38,500 into a retirement plan? A Milwaukee Journal Sentinel article states, “Posley will continue receiving his salary through June. His [Posley’s] annual salary is about $303,000 per year. Graduate rates in the high 60% and pay of $303,000 per year?

MPS hires a company to look at what schools should be closed. MPS doesn’t know how size of buildings, their condition, and the number of students attending? An outside company has to be hired?

MPS also hired a company to help find a replacement Superintendent. Do we need a new Superintendent? Wouldn’t an ad in the newspaper work?

Should pay be based on performance? Nothing is paid unless there are improvements in graduation rate and test scores, . . . .

We, the voters, are responsible for selecting board members who are responsible for oversight. Something isn’t working when money is given away to a person who has failed. I thought the money was supposed to be used to improve education outcomes.

Education is important—I’m not sure why the Wisconsin Government doesn’t see that.

But understand—the State Government has again decided that increasing the size of the Engineer School at UW Madison isn’t important.

My property tax went up 100% – I’m also concerned. But, even more concerned about waste and lack of accountability.

Nobody’s property tax is up 100%. Not without massive changes in property value too (which again hasn’t been up 100s% so this doesn’t add up).

I have a condo, and its value went up 100%. I’ll check when I get home—I could be mistaken. I plan to send in an appeal. If I’m wrong, I will post an update.

. . .

Pretty anodyne treatment of a major issue for Milwaukeeans, Jeramey. As these comments show, homeowners and renters are wound up about this. Never forget- MPS sprung the referendum on the public quickly and it was nearly defeated once people started realizing how much their property taxes and/or rent would increase. This tax will result in people leaving the city, and other becoming residentially unstable. The MPS tax is a “forever” tax, not a one time thing. It was particularly sad that both David Crowley and Chevy Johnson endorsed the tax and stabbed their constituents in the back.

@Colin – The graphics are from the Comptroller’s Office and are produced every year. They are included with the mailed tax bills.

Ruth Coniff wrote an article that appeared on DEC 16th. Some excerpts of the article NOBODY COMMENTED ON…

“… the Legislature’s stinginess when it comes to the state’s share of school funding is a major driver of property tax increases.

…the historic number of school district referenda passed by local communities. Local property taxpayers voted to raise their own taxes. And why is that? Because the Legislature refused to give school districts enough money in the state budget to cover their costs.

… take a look at how little of that $1.2 billion in “education spending” actually went to schools.

… the Fiscal Bureau reports that “total school aid” in the 2023-25 budget came to $625 million. Where did the rest (of the $1.2B) go?

… under the heading “school levy tax credit” you will find the missing $590 million in so-called school funding, in the form of a rebate to property taxpayers. Schools never get to touch that money. It is an oddity of Wisconsin law that the school levy tax credit is labeled as school funding.

… had the Legislature actually put $590 million into school funding, schools would have been in a much better financial position, and we probably would not have seen a record-breaking number of districts asking property taxpayers to hike their own taxes to keep their local schools afloat.

I don’t understand how the sales tax works (I’m not sure if anyone does). Sales tax is collected in Milwaukee, sent to Madison, and then…

Why does sales tax collected in Milwaukee go to Madison? I understand the income tax. Why does any of the sales tax go to Madison?

Then there is the just dumb. Not fully funding the UWM Madison Engineering School. It is really – just dumb. Talk about failing the state and country. President Eisenhower would be rolling over in his grave. Just looking at National Defense – we need more engineers. Then there is the quality of life. But, those “SMART ELECTED OFFICIALS IN THE STATE GOVERNMENT” don’t want to fund the expansion of the Engineering School? Are they invested in Chinese – overseas stocks? They don’t want to see improvements in the US Economy? I know they want companies from Taiwan to bring their engineers to the US and build a factory to make flat screens.

Hard to believe. . . .