Wisconsin’s State and Local Tax Burden Is Now Well Below National Average

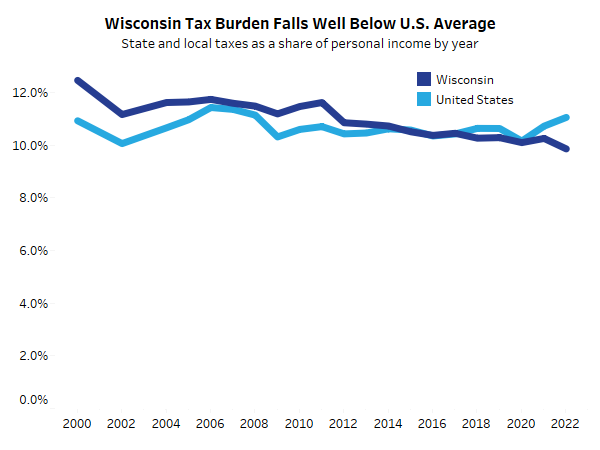

New Wisconsin Policy Forum report finds state's tax burden has trended down for 25 years.

Cash. (CC0)

Wisconsin residents and businesses pay less than 10% of their income on state and local taxes, according to a new report published Friday, continuing a trend that has been underway for more than two decades.

The report, produced by the Wisconsin Policy Forum, credited rising incomes, a 2021 state income tax cut and state limits on local property tax increases for helping to reduce Wisconsin’s state and local tax burden.

The trend might not last, however. Initial information on collections suggest little change in the state and local tax burden for 2023, which could continue in 2024 and 2025, the report states. While income growth has been strong, “taxes have also grown in at least some areas.”

On average nationwide, state and local taxes amounted to 11.1% of individual and business income in 2022, according to the report — 1.2 percentage points more than Wisconsin. The share of Wisconsin income going to those taxes “has never been so far below that of the nation,” the report states.

The report reflects only state and local taxes, not federal taxes, which the Wisconsin Policy Forum analyzes separately.

While Wisconsin taxpayers are paying a little less, the state is also paying a smaller share of its income, particularly for education, the report finds.

Direct state and local spending grew by 7% in 2022, reaching $65.06 billion. But spending fell as a share of state income, to 18.3% in 2022 from 18.6% in 2021.

“Overall K-12 spending in Wisconsin rose 4.4% in 2022, but that was less than half of the 9.8% increase nationally,” the report states. Spending on K-12 education was 5.1% of state income in 2000 — the eighth highest among states. By 2021 it had dropped to 3.9%, and by 2022, to 3.8% — ranking 31st from the top.

“This represents a major shift in the single largest area of state and local spending,” the report states.

The report sets the stage for the top priority for lawmakers and Gov. Tony Evers in the coming year — drawing up Wisconsin’s 2025-27 state budget, with likely debates over school funding and the state’s projected surplus of about $4 billion.

A trend for two decades

In the year 2000, Wisconsin ranked third among the 50 states in the share of personal income going to state and local taxes, according to the Wisconsin Policy Forum. By 2022, the state’s rank had dropped to 35, an all-time low.

Wisconsin’s ranking in taxes per capita has also fallen. In 2021, when the total annual state and local tax bill averaged $5,689 per capita, the state was in 24th place. In 2022, Wisconsin’s fell to 29th place, with an average bill of $5,966 per capita.

The share of income from Wisconsin individuals and businesses that goes to pay state and local taxes has been shrinking for more than two decades, Wisconsin Policy Forum calculations show. (Graphic courtesy of Wisconsin Policy Forum)

The single largest contributor to Wisconsin’s lower tax burden was a change in the state income tax brackets included in the 2021-23 state budget, reducing the third bracket from the bottom to 5.3% from 6.27% — reducing state tax revenue by $1 billion in 2022.

The report points out that its calculation “shows only a drop in Wisconsin’s average tax burden — some taxpayers here benefited less and others more.”

Legislative Fiscal Bureau estimates compiled when the change in the third bracket took effect “showed 98.9% of the total decrease was expected to go to tax filers with state Adjusted Gross Income of more than $40,000 and 74% of the total to filers with income of more than $100,000,” the report states.

Two other changes may have contributed to that shift, according to the report. One affected business owners who received Paycheck Protection Act pandemic relief loans, but then were allowed to keep the money instead of repaying it to the federal government. In 2021 Wisconsin enacted legislation waiving state income taxes on those funds.

In addition, Wisconsin revised its income tax tables for 2022, reducing the amount of tax money the state collected that would subsequently be refunded to taxpayers.

Corporate income and general sales tax revenues also grew more slowly in Wisconsin compared to nationally, the report said, also likely contributing to the state’s lower relative tax burden.

The report found that property taxes, which fund public schools and local and county government, grew 2.9% in 2022, keeping pace with the national average.

Wisconsin’s 2021-23 state budget included a freeze on per-pupil revenue caps to local school districts. That limited how much local districts could raise property taxes without getting voters’ permission through a referendum, as well as how much state aid they could collect. As a result, the share of Wisconsin income paid to property taxes dropped to 3% in 2022 from 3.2% in 2021, “contributing a significant share of the overall decrease in the state’s tax burden,” the report states.

“The state’s higher than average property taxes — particularly on homes — remain the most salient tax for most state residents,” the report states. “That may keep some taxpayers from grasping the overall decrease in taxes that has taken place over the past two decades.”

Where costs are rising

Higher education spending has risen slightly in recent years, from 1.8% in 2021 to 1.9% in 2022, and Wisconsin’s rank has risen, too, to the 20th highest state on that measure.

Spending by state and local government on the prison system, jails and other corrections costs rose 11.3% in 2022, with Wisconsin ranking 9th among states in its corrections spending as a share of state income, according to the report.

Public social services spending, such as for Medicaid, increased 6.5% in 2022. Wisconsin ranks 21st nationally for that spending as a share of state income.

Looking ahead, the report suggests that the 2024 wave of successful referendum measures, primarily for public schools, will lead to property tax increases by the end of this year.

“These increases should also help to counteract at least somewhat the drop in K-12 spending levels as local school leaders try to rebuild their budgets after the two recent years of frozen revenue limits,” the report states.

But it also forecasts conflicts ahead between lawmakers who have continued to press for reducing Wisconsin taxes and the Evers administration as well as local taxpayers who approved school referendum questions and want to see increased financial support for public schools in the 2025-27 budget.

Wisconsin residents pay less in state and local taxes, new report finds was originally published by Wisconsin Examiner.