Will a Flat Tax Grow State’s Economy?

The data for other states doesn't support this claim.

Recently a number of conservative groups have been pushing to replace Wisconsin’s progressive income tax, in which the tax rate rises as a taxpayer’s income rises, with a flat tax, under which everyone pays the same percentage of taxable income. Registering to lobby for this are a who’s who of Wisconsin’s conservative establishment, including the Badger Institute, Wisconsin Institute for Law & Liberty (WILL), Wisconsin Manufacturers and Commerce (WMC), and Americans For Prosperity. Even Wisconsin Family Action, better known for opposition to abortion rights, is listed as supporting the proposed flat tax.

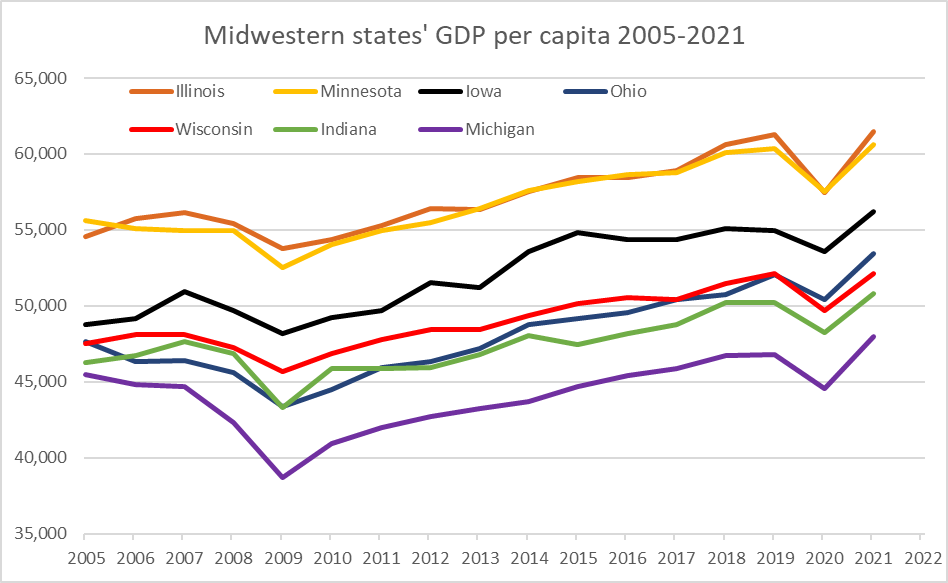

The accompanying reports point out that Wisconsin’s economic growth ranks in the middle among other midwestern states and seems stuck there. The following graph shows the gross domestic product per capita for Wisconsin (shown in red) and six other midwestern states. The solution, it claims, is to reduce taxes on wealthy people.

That approach is contained in bills introduced in the state Legislature: Senate Bill 1 and Assembly Bill 1 (SB1 and AB1). A fact sheet prepared by the Badger Institute makes the following claims about a flat tax:

A flat tax would dramatically improve Wisconsin’s standing in an increasingly competitive tax environment – and could be done without raising taxes on anyone.

Two problematic assertions underlie this statement. The first is the idea that reducing the tax that wealthy people pay is the key to prosperity. This strategy stems from the notion that low taxes on wealthy people and prosperous companies will cause wealthy people to move to or stay in Wisconsin and invest in the state. Therefore, states that rate high for fairness should have weak economies and those rating low should have strong economies.

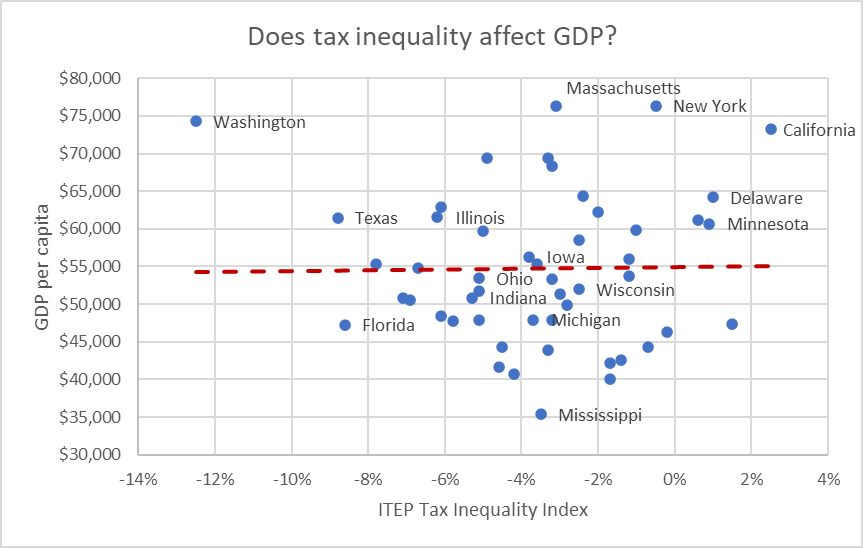

If low taxes on wealthy people did lead to greater economic activity, one would expect states’ gross domestic product (GDP) to reflect that. States rated high on the fairness ratings developed by the liberal Institute on Taxation and Economic Policy (ITEP) would be expected to pay the price in reduced GDP. By the same token, states rated high by the conservative Tax Foundation would have higher average GDPs.

ITEP starts by analyzing the percentage of income that people of varying incomes pay in state and local taxes. Then they use that data to develop a Tax Inequality Index. The index is positive if low-income residents pay a lower percentage of their income in taxes than do those with higher incomes. It is negative if the tax rate is higher for those with lower incomes. In other words, states with progressive overall tax systems are rated positive. Those states with regressive tax systems get a negative rating.

The next graph tests this hypothesis. Each dot represents a state. The horizontal axis shows the state’s tax fairness rating from ITEP. The vertical axis shows each state’s GDP per capita in 2021, the latest year for which it is available. The way the points (representing states) are scattered on the graph tells us there is no real trend here: the two variables are independent of each other and tax fairness has no effect either positive or negative on GDP.

This conclusion is supported by the flat trend line (red dashes). It is notable that the state rated worst—Washington—and best—California— for tax fairness are both among the four states with the highest GDP per capita.

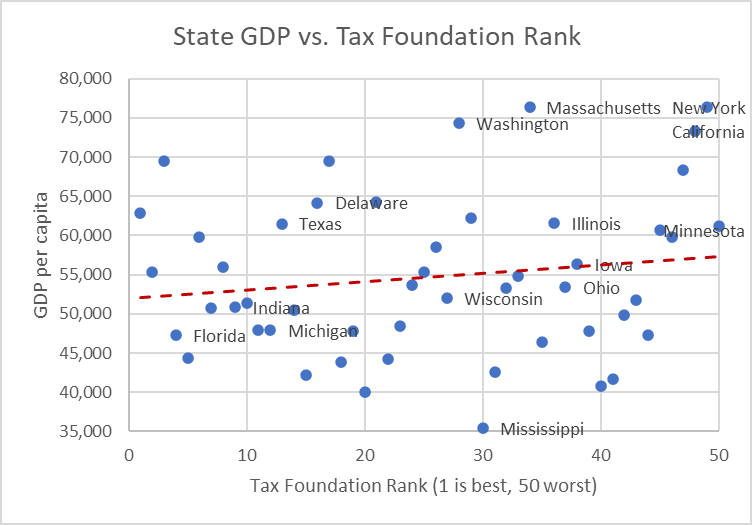

The Tax Foundation also rates state tax systems. According to the foundation, its State Business Tax Climate Index “enables business leaders, government policymakers, and taxpayers to gauge how their states’ tax systems compare.” The graph below compares states’ per capita GDP (on the vertical axis) to its tax climate index rank (on the horizontal scale). Note that low ranks are best and high ranks are worst.

Once again the scatter of the points (representing states) suggests there is no strong trend here. If anything the direction of the trend line (red dots) shows a negative correlation between the Tax Foundation’s ratings and state GDP, but a very weak one. I interpret that result to say the two variables are independent of each other.

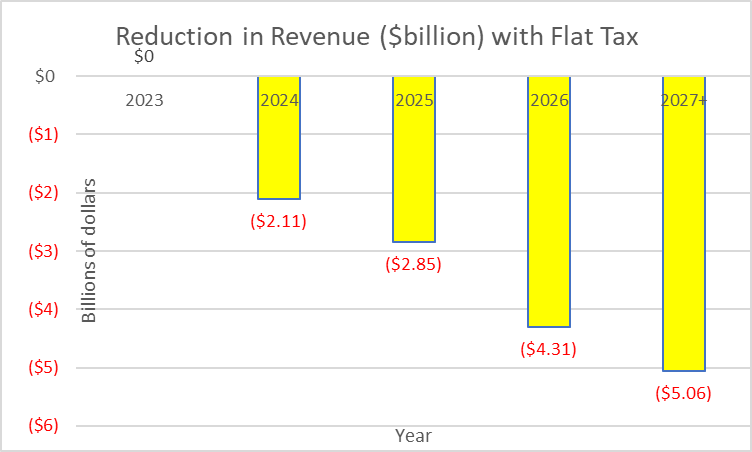

Requiring the flat tax to generate the same revenue as the present graduated tax would have required increased taxes on low- and middle-income taxpayers to compensate for lower rates on wealthy taxpayers. As the next graph shows, the tax when fully implemented would result in a revenue shortfall of around five billion dollars according to the Wisconsin Fiscal Bureau’s estimated fiscal Impact of AB1 and SB1.

Also, advocates point to the sales tax as a possible source of revenue to make up for the shortfall. The sales tax is notoriously regressive. So, in the end, low- and middle-income people would end up paying for lower taxes on wealthy people.

The push to convert Wisconsin’s graduated income tax into a flat tax stems from a belief in the myth of the over-taxed plutocrat. According to this myth reducing this tax will motivate wealthy residents to stay in Wisconsin and invest in Wisconsin.

To overcome criticisms that this proposal would shift the burden of taxes, the authors of the tax propose a substantial reduction in state revenues. The result may be cuts to programs that Wisconsinites depend on such as Badgercare, revenue shared with local governments, and school aids.

Data Wonk

-

Life Expectancy in Wisconsin vs. Other States

Dec 10th, 2025 by Bruce Thompson

Dec 10th, 2025 by Bruce Thompson

-

How Republicans Opened the Door To Redistricting

Nov 26th, 2025 by Bruce Thompson

Nov 26th, 2025 by Bruce Thompson

-

The Connection Between Life Expectancy, Poverty and Partisanship

Nov 21st, 2025 by Bruce Thompson

Nov 21st, 2025 by Bruce Thompson

Most states with a flat tax don’t actually have a true flat tax, as deductions and credits still exist that are most commonly used most by the wealthier citizens. If looking at actual income vs taxable income, states with a flat tax most likely have the lowest effective tax rates for the wealthy, and the highest for the poor or middle class. This could complicate the data presented here, or it is just true no matter how you slice it that tax rates aren’t significantly related to economic growth (global data also shows this).