Hospitals Wait In Line for Injury Lawsuits

They are increasingly filing liens against uninsured patients in case they sue someone for damages.

Like many patients in similar circumstances, Maneisha Gaston was confused to learn that Froedtert Hospital filed liens against her and her son to recover the cost of treating their car crash injuries. She initially worried the liens applied to the home she proudly purchased three years ago on Milwaukee’s North Side. Instead, the legal filing would reduce compensation she might receive from a crash-related lawsuit — if one is filed. Gaston is seen here outside her home on Dec. 21, 2020. Coburn Dukehart / Wisconsin Watch

Maneisha Gaston was driving west on Milwaukee’s Brown Street with her 15-year-old son when another driver blew through a stop sign, crashed into the passenger side of her car and fled the scene.

“The whole door was crushed like a piece of paper,” Gaston recalled of the October incident.

Gaston declined treatment from paramedics at the scene. Instead, her mother came to drive Gaston and her son to the emergency room at Froedtert Hospital in Milwaukee. Gaston, who lacks health insurance, recalled waiting nearly two hours before receiving an X-ray, ibuprofen, Tylenol and advice to follow up with her doctor.

Three weeks later, she learned by certified mail that the hospital filed a $2,314.98 lien against her and one against her son for $1,044.34 — to cover her bill from the visit. But what did that mean?

Gaston initially worried the lien was filed against the home she proudly purchased three years ago on Milwaukee’s North Side. That was not the case. Instead the legal filing would reduce compensation she might receive from an accident-related lawsuit — if one is filed.

“They just sent me this bill saying that they were going to put a lien on my name, and I just kind of panicked,” Gaston said. “I had to seek some advice.”

Maneisha Gaston and her son were injured in October of 2020 when another driver blew through a stop sign and crashed into the passenger side of her car before fleeing the scene. Three weeks after receiving treatment for her injuries at Froedtert Hospital in Milwaukee, Gaston learned by certified mail that the hospital filed about $3,300 in liens against her and her son — to potentially cover her bill from the visit, since she lacked health insurance. Gaston is seen here outside her house in Milwaukee on Dec. 21, 2020. Coburn Dukehart / Wisconsin Watch

Froedtert is increasingly lining up for a cut of compensation in injury lawsuits by filing liens. The filings come as the hospital delivers on a promise to stop directly suing patients over debt during the COVID-19 pandemic.

In April, Froedtert dropped more than a dozen debt lawsuits after a Wisconsin Watch/WPR investigation revealed the hospital and others in Wisconsin were suing patients during the pandemic who struggled to pay medical bills. Froedtert vowed to suspend such small claims suits. The hospital has followed through on that promise — while filing more liens against patients. Some hospitals elsewhere, including Froedtert South in Kenosha, are continuing to sue patients over alleged debt, a more aggressive tactic that can damage credit histories.

Froedtert filed 362 hospital liens through Dec. 11 of this year, including 251 since May. That outpaces the 300 liens it filed in all of 2019.

Stephen Schooff, a spokesman for Froedtert Health, said the hospital’s volume of lien filings “aligns with the number of Froedtert Health hospital cases resulting from auto accidents.”

Indeed, Milwaukee County this year has seen an increase in serious car crashes, even during a pandemic that has limited traffic.

The practice also happens at nonprofit hospitals in Wisconsin. SSM Health, which owns hospitals and clinics across Wisconsin, filed at least 116 liens this year though Dec. 11, court records show. UW Health in Madison filed at least 67, while La Crosse-based Gundersen Health System filed at least 49. Aspirus Wausau Hospital filed at least another 13 liens.

“Hospitals attempt to balance their responsibility to be good stewards of resources to ensure they can best serve their communities,” said Kelly Lietz, a Wisconsin Hospital Association spokesman. “Hospitals prefer not to go to court or file liens, so those actions really are a last resort, taken only after all other options are exhausted.”

Thomas Russell, a UW Health spokesman, said hospital liens are “very rare and only apply in the case of a personal injury settlement.”

But filing a lien without explanation can leave patients confused.

“Their immediate thought is — like when someone files a lien on your house, or they’re going to garnish your wages, said Lance Trollop, a personal injury attorney in Wausau. “It’s scary when you have all this coming at you at once, with medical bills and insurance calls and forms.”

Liens can siphon off large portions of a patient’s injury compensation. And that payment is typically more than a hospital would collect from an insurer for the same care.

Consumer advocates say the process illustrates one way that the American health care system leaves uninsured patients on the hook for “fictional” health care prices that don’t reflect the actual cost of care.

How liens work

Gaston fits the typical profile of people facing hospital liens, experts say: uninsured patients who have been injured in car crashes, although liens could also be filed in other cases involving negligence or wrongful conduct.

In the event of a legal settlement over an injury, hospitals get paid before the discharged patient.

Wisconsin hospitals mostly file liens against people involved in car crashes because they are easier to file, says Trollop. Crashes typically generate a police report with the names of the people involved, their insurance companies and other useful information. Those cases are also more likely to yield a payout, Trollop added.

Lien recipients usually lack insurance, but hospitals treating some publicly insured patients — those enrolled in Medicare, for example — may choose whether to bill the public insurer or file a potentially more lucrative lien.

If a patient does not file a lawsuit over their injuries hospitals can still try to collect a debt in other ways — including by suing the patient, Trollop said.

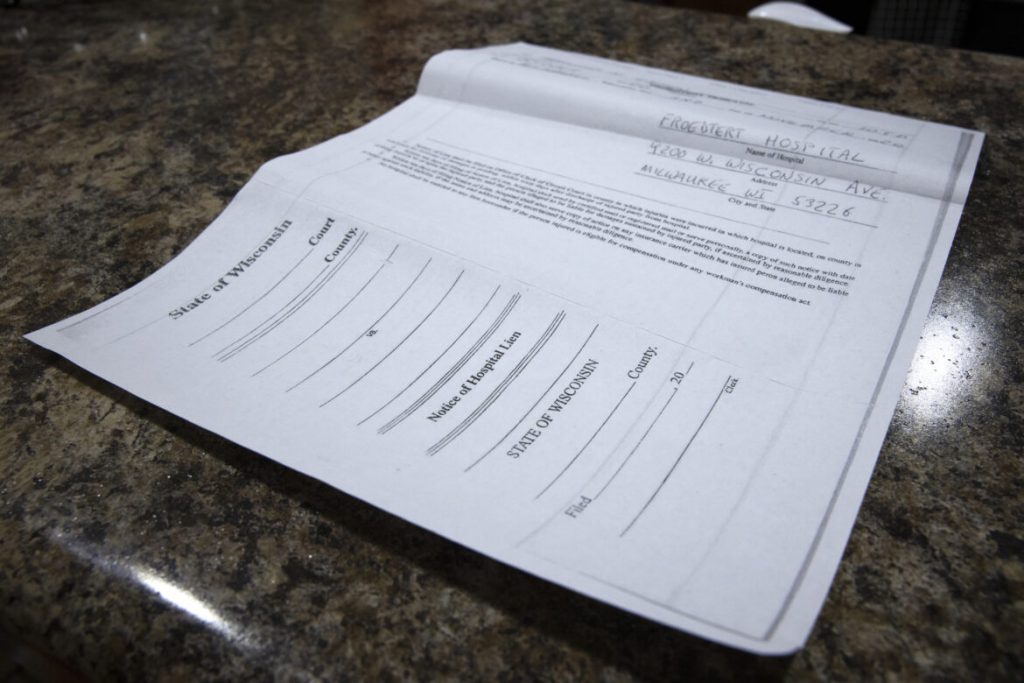

The hospital lien filed against Maneisha Gaston sits on her kitchen counter in Milwaukee. Some people are confused after learning that a hospital has filed a lien against them to recoup the cost of treating their injuries. “Their immediate thought is — like when someone files a lien on your house, or they’re going to garnish your wages, says Lance Trollop, a personal injury attorney in Wausau. “It’s scary when you have all this coming at you at once, with medical bills and insurance calls and forms.” Coburn Dukehart / Wisconsin Watch

How much would Gaston owe if Froedtert pursued payment outside of the lien? That’s not clear. But possibly very little if she applied for charity care.

Like other nonprofit hospitals, Froedtert offers a charity care program — part of its commitment as a nonprofit to serve the community in exchange for tax breaks and other benefits. Patients who earn up to two and a half times the federal poverty level could qualify for free care under the program, while patients above that threshold may be eligible for discounts of 65- to 90% on a sliding scale.

Froedtert debts resolved through an injury settlement are ineligible for charity care, Schoof said.

Gaston described her earnings as a business analyst as “just a little above” the $43,100 annual limit for she and her son to qualify for free care as a family of two.

When she visited Froedtert in October, Gaston said someone gave her information about the hospital’s financial assistance policy and told her someone would call about her billing options. Gaston did get a voicemail about billing. She received the hospital liens a week or two later, she said.

How much does a patient owe?

In filing roughly $3,300 in liens against Gaston and her son, Froedtert is likely seeking to recoup “chargemaster prices” — sticker prices for medical care.

Maneisha Gaston is seen inside the kitchen of her Milwaukee home on Dec. 21, 2020. She fits the typical profile of people facing hospital liens, experts say: uninsured patients who were treated for car crash injuries. Crashes typically generate a police report with the names of the people involved, their insurance companies and other useful information. Those cases are also more likely to yield a settlement or judgment from which a hospital would be paid. Coburn Dukehart / Wisconsin Watch

“It’s been my experience in defending hospital lawsuits that it’s difficult for hospitals to prove reasonable value of their services,” said Mary Fons, a consumer protection attorney in Stoughton. “They just have their prices.”

Nicholas Bagley, a University of Michigan law professor, described chargemaster prices as “basically fictions” that should serve as the starting point for cost negotiations.

“Insurance companies are supposed to be our agents,” Bagley said. “And they’re supposed to negotiate hard with these big hospital systems to come up with reasonable rates for the services they provide.”

The arrangement works for insurers, he added, because the companies hold leverage over hospitals and clinics; they pay health care bills of many patients and can threaten to exclude hospitals and providers from their networks. But that process breaks down for the poor and uninsured, sticking them with a “fictional fee” for care.

Individual patients — even those with attorneys — lack the bargaining power of an insurance company. Trollop, the Wausau attorney, said hospitals have no obligation to budge, although sometimes they do.

James Payne, a personal injury attorney in Kenosha, said even a lien negotiated down to half price in a settlement will cost a patient more than private insurers would pay for the same care — and far more than Medicare and Medicaid would pay.

Some hospital liens can jeopardize an injury settlement, particularly if they are large, Trollop said. Settling makes little sense, for instance, if a hospital demands a sum near the cap that the at-fault driver’s insurance policy is willing to pay.

“My client isn’t going to sign off on a settlement that only pays back the hospital lien,” Trollop said. “The uninsured person is going to walk away with less money in the end.”

No lawsuit, but debt lingers

After considering her options with a lawyer, Gaston said she probably will not sue the driver who totaled her car. The driver doesn’t have car insurance, she said, adding that he might face a hit and run charge. Avoiding legal action would render the Froedtert lien moot. But her medical bills remain unpaid, and that issue could take longer to resolve.

Gaston said she doesn’t have an extra $3,300 just sitting around, but she plans to prioritize the bill if necessary.

Schooff, the Froedtert spokesman, said a lien rendered moot by a lack of a lawsuit would not preclude a patient from applying for charity care. (He could not respond directly to Gaston’s case because of privacy considerations.)

As she sorts out the aftermath of her collision, Gaston is also recovering from COVID-19, which she caught a few weeks before Thanksgiving.

After she emerged from 10 days of isolation, Gaston learned that her grandmother died from conditions unrelated to COVID-19, making a hard year even harder. She is now taking solace in how funerals bring families together.

This story comes from a partnership of Wisconsin Watch and WPR. Bram Sable-Smith is WPR’s Mike Simonson Memorial Investigative Reporting Fellow embedded in the newsroom of Wisconsin Watch (wisconsinwatch.org), which collaborates with WPR, PBS Wisconsin, other news media and the University of Wisconsin-Madison School of Journalism and Mass Communication. All works created, published, posted or disseminated by Wisconsin Watch do not necessarily reflect the views or opinions of UW-Madison or any of its affiliates.

-

Legislators Agree on Postpartum Medicaid Expansion

Jan 22nd, 2025 by Hallie Claflin

Jan 22nd, 2025 by Hallie Claflin

-

Inferior Care Feared As Counties Privatize Nursing Homes

Dec 15th, 2024 by Addie Costello

Dec 15th, 2024 by Addie Costello

-

Wisconsin Lacks Clear System for Tracking Police Caught Lying

May 9th, 2024 by Jacob Resneck

May 9th, 2024 by Jacob Resneck