Pandemic Creates Plague of Evictions

11,600 in Houston, 4,000 in Milwaukee. CDC aims to curb them.

Robert and Stephanie Pettigrew are seen outside of their two-bedroom apartment in Milwaukee on Sept. 4, 2020. Robert, who has a mass on his lung, pursues odd jobs to help put food on the table after leaving a job at Motel 6 for fear that exposure to the coronavirus could trigger severe COVID-19 complications. The family narrowly avoided an eviction after Community Advocates, a nonprofit helping to administer Milwaukee County’s rental assistance program, provided more than $4,700 in emergency rental aid. The U.S. Centers for Disease Control and Prevention has since ordered a nationwide eviction moratorium through the end of 2020, hoping to slow the spread of the virus. The moratorium spotlights a message experts have preached for years: housing stability and health are intertwined. Photo by Coburn Dukehart/WisconsinWatch.

When Robert Pettigrew finally saw the sign in August, he believed the “good Lord” had placed him in front of it.

The sign appeared months after a doctor advised the 52-year-old to stop manning the front desk at Motel 6 as a mass on his lung and bouts with pneumonia restricted his breathing. Pettigrew saw the sign after his 25-year-old daughter and her son moved into his Milwaukee apartment where Pettigrew was six months late on rent. After Wisconsin lifted a ban on most evictions during the coronavirus pandemic. And after a landlord filed to evict Pettigrew and his wife, Stephanie.

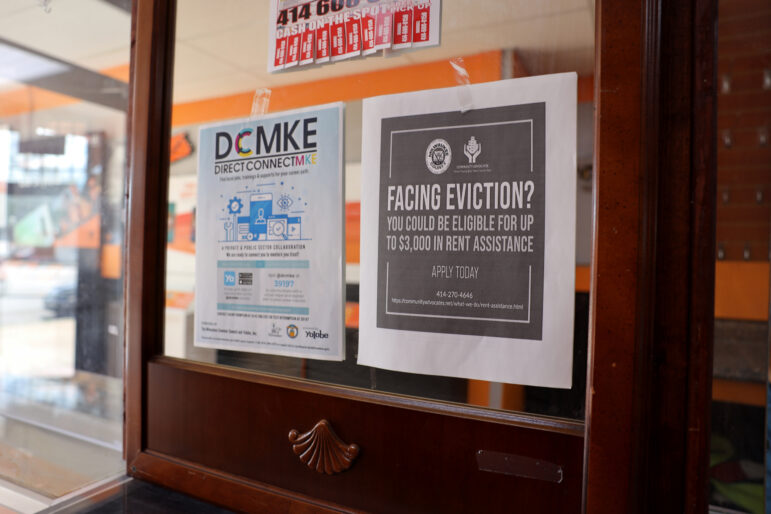

Only then did Pettigrew glimpse the paper sign while being paid $20 to wash windows at Boost Mobile on Atkinson Avenue. The message: “Facing eviction? You could be eligible for up to $3,000 in rent assistance. Apply today.”

“There were nights I would lay in bed and my wife would be asleep, and all I could do was say, ‘God, you need to help me. We need you,’ ” Pettigrew said. “And here He came. He showed himself to us.”

Pettigrew’s household is among more than 4,000 in Milwaukee to face eviction since the coronavirus began spreading, according to data compiled by Princeton University’s Eviction Lab, which is tracking evictions in 17 cities during the pandemic. The Milwaukee filings eclipsed pre-pandemic averages in June and July but fell below averages for August.

As of Sept. 19, landlords in Eviction Lab-tracked cities had filed for more than 50,000 evictions since March 15, including about 11,600 in Houston, 10,900 in Phoenix and 4,400 in Columbus, Ohio. The incomplete snapshot excludes major American cities such as Indianapolis, where local housing advocates say landlords have sought to evict thousands of renters but court cases are difficult to track.

As many as 40 million Americans faced a looming eviction risk in August as millions remain jobless, with inconsistent access to public assistance, according to a report authored by 10 national housing and eviction experts. The U.S. Centers for Disease Control and Prevention cited that estimate on Sept. 1 in ordering an unprecedented nationwide eviction moratorium through the end of 2020.

That the country’s top public health agency ordered the moratorium spotlights a message experts have preached for years without prompting major policy action: housing stability and health are intertwined.

Mounting research illustrates that even the threat of eviction exacts a physical and mental toll from tenants. Children raised in unstable housing are more prone to hospitalization than children with stable housing. Homelessness is associated with delayed childhood development, and mothers in families that lose homes to eviction show higher rates of depression and other health challenges.

The CDC is now citing stable housing as a vital tool to control COVID-19, which has killed nearly 200,000 Americans. Home is where people isolate to avoid transmitting coronavirus or becoming infected, and governments count on residents having a home when issuing stay-at-home orders in the name of public health. Home is where to recover from COVID-19’s fever, chills, muscle pain and trouble breathing — in lieu of or after a hospital stay.

The CDC’s order comes nearly six months into the worst economic crisis since the Great Depression, as millions of Americans, like the Pettigrews, fight to stay in their homes — if they haven’t lost them already.

Searching for help to stay at home

The cell phone store sign directed Pettigrew to Community Advocates, a nonprofit that received $7 million in federal pandemic stimulus funds to help administer Milwaukee County’s rental aid program. More than 3,800 aid applications have flooded the agency, said Deborah Heffner, its housing strategy director, while tens of thousands more applications have flowed to a separate agency administering the state’s rental relief program in Milwaukee.

Persistency helped the Pettigrews break through the backlog.

“I blew their phone up,” said Stephanie Pettigrew.

She has endured a range of medical procedures that limit her own ability to work: two hip replacements, a prosthetic disc in her neck, two carpal tunnel surgeries and a rotator cuff surgery.

“They took half my body parts,” she joked.

That qualifies her for federal Social Security Disability Insurance, which supports people who have worked and paid Social Security taxes but can no longer perform “substantially gainful activity.” The program sends Stephanie Pettigrew $400 to $900 in monthly assistance — increasingly vital income since March, when Robert left his motel job so as not to risk life-threatening complications from any exposure to coronavirus.

He has since pursued a host of odd jobs to keep food on the table: washing windows, cutting grass, washing cars — work where he could limit contact with people. He brings home $40 on a good day, he said, $10 on a bad one.

February was the last time the Pettigrews could fully pay their $600 monthly rent before they qualified for rent assistance in August. And they have welcomed two more family members in recent months into their tenuous living arrangement.

Robert and Stephanie Pettigrew are seen with their daughter Heavenly Pettigrew outside of their two-bedroom apartment in Milwaukee on Sept. 4, 2020. Robert, who has a mass on his lung, left his job at Motel 6 after the pandemic struck for fear of suffering severe complications from any exposure to the coronavirus. Stephanie, who has her own health challenges, receives $400 to $900 each month in Social Security Disability Insurance — increasingly vital income for the family. The couple has struggled to pay their $600-a-month rent on their apartment during the pandemic, prompting their landlord to seek an eviction. The Pettigrews avoided losing their home to eviction after getting more than $4,700 in emergency rental relief from Community Advocates, a nonprofit group that helps administer Milwaukee County’s rental aid program. The group is now helping the family look for a less expensive apartment. Photo by Coburn Dukehart/WisconsinWatch.

Robert’s daughter Heavenly arrived in May from St. Louis after the day care where she worked shut down due to the virus. She brought her 3-year-old son. Through its order, CDC hopes to avoid evictions that funnel additional family members and friends under one roof. The federal order notes that “household contacts are estimated to be 6 times more likely to become infected by (a person with) COVID-19 than other close contacts.”

The Pettigrews’ Milwaukee apartment — a kitchen, a front room, two bedrooms and one bathroom — offers little way for three generations to keep much distance.

“But it’s our home,” Robert said. “We’ve got a roof over our head. I can’t complain.”

Patchwork of rental aid programs

A U.S. Census Bureau survey conducted before the CDC’s order estimated that 5.5 million American adults — including tens of thousands in Wisconsin — feared they were either somewhat or very likely to face eviction or foreclosure in the next two months.

State and local governments nationwide are offering a patchwork of help for those people.

In Massachusetts, the governor extended the pause on evictions and foreclosures until October 17. Landlords are challenging that move both in state and federal court, but both courts have let the ban stand while the lawsuits proceed.

“Access to stable housing is a crucial component of containing COVID-19 for every citizen of Massachusetts,” wrote Judge Paul Wilson in a state court ruling. “The balance of harms and the public interest favor upholding the law to protect the public health and economic wellbeing of tenants and the public in general during this health and economic emergency.”

The cases from Massachusetts offer one glimpse into how federal challenges to the CDC order could play out.

By contrast Wisconsin Gov. Tony Evers lifted the state’s 60-day moratorium on May 26, opening the gates to a surge of eviction filings: at least 8,275 statewide through Sept. 15, according to a search of an online database of Wisconsin circuit court cases.

Milwaukee has seen nearly half of those filings, which are disproportionately hitting Black-majority neighborhoods, according to an Eviction Lab analysis.

Housing advocates are documenting similar disparities in other states.

“This deadly virus is killing people disproportionately in Black and brown communities at alarming rates,” said Dee Ross, founder of the Indianapolis Tenants Rights Union. “And disproportionately Black and brown people are the ones being evicted at the highest rate in Indiana.”

Governments across the country have set aside millions in federal pandemic aid for struggling renters and homeowners.

That includes $240 million earmarked between Florida’s state and county governments for rent and mortgages, $100 million for renters in Los Angeles County and $18 million in Mississippi. Without assistance, tenants’ debts would only grow even during an eviction moratorium, making people vulnerable to losing their homes once the order ends.

In Wisconsin, Evers set aside $25 million in federal pandemic dollars for statewide renter relief. But barriers have limited access to that program, including backlogs of applications and requirements that leave out some renters in need.

In Indiana, more than 36,000 people applied for that state’s $40 million rental assistance program before the application deadline. Marion County, home to Indianapolis, had a separate $25 million program, but it cut off applications after just three days because of overwhelming demand. About 25,000 people sat on the county’s waiting list in late August.

Andrew Bradley, policy director of the economic development organization Prosperity Indiana, said he fears still more renters remain unaware of the available resources.

“We’re not confident that the people who need the help most even know about the program, that there’s been enough proactive outreach to get to the households that are most impacted,” Bradley said.

That might have been the case for Pettigrew in Milwaukee — if not for the Community Advocates sign.

A sign inside a Boost Mobile store on Milwaukee’s Atkinson Avenue prompted Robert Pettigrew to apply for emergency rental aid to avoid being evicted from the two-bedroom apartment where he lives with his wife Stephanie Pettigrew, daughter Heavenly Pettigrew and grandson. “There were nights I would lay in bed and my wife would be asleep, and all I could do was say, ‘God, you need to help me. We need you,’ ” says Robert, who has a mass on his lung and works odd jobs to help keep food on the table. “And here He came. He showed himself to us.” Photo taken Sept. 4, 2020. Photo by Coburn Dukehart/WisconsinWatch.

The group in August covered more than $4,700 in the Pettigrews’ rental payments, late charges, utilities and court fees. It also referred the couple to free legal help through the Legal Aid Society of Milwaukee, which moved to seal the eviction case so as not to damage the Pettigrews’ renting record.

“Community Advocates really did what they needed to do to help people,” Stephanie Pettigrew said.

That helped guarantee the family housing at least through September. And the CDC order added more security as Robert awaits word on whether he must undergo lung surgery that would require a weeks-long recovery.

The federal eviction moratorium, if it withstands legal challenges from housing industry groups, “buys critical time” for renters to find assistance through the year’s end, said Emily Benfer, founding director of the Wake Forest Law Health Justice Clinic.

“It’s protecting 30 to 40 million adults and children from eviction and the downward spiral that it causes in long term, poor health outcomes,” she said.

But the moratorium is not automatic. Renters have to submit a declaration form to their landlord, agreeing to a series of statements under threat of perjury, including, “my housing provider may require payment in full for all payments not made prior to and during the temporary halt and failure to pay may make me subject to eviction pursuant to state and local laws.”

Confusion surrounding the CDC’s order means some tenants are still being ordered to leave their homes.

And without unlocking additional funds for rental assistance, Benfer added, the moratorium merely stalls the evictions crisis rather than solve it — temporarily shifting the burden from tenants to landlords as existing nationwide aid programs fall short in meeting demands.

Doctor: Evictions akin to ‘toxic exposure’

Dr. Megan Sandel, a pediatrician at Boston Medical Center, said at least a third of the 14,000 families whose children are seen at the center have fallen behind on their rent, a figure mirrored in national reports.

Hospital officials worry that an evictions spike would trigger a surge of patients experiencing homelessness, who are more challenging and expensive to treat. One study from 2016 found that stable housing reduced Medicaid spending by 12%. That is because while primary care use increased 20%, more expensive emergency room visits dropped by 18%.

A year ago, Boston Medical Center and two area hospitals collaborated to invest $3 million in emergency housing assistance and community organizing focused on affordable housing policies and development. Now, the hospitals are looking for additional emergency funds, trying to boost legal resources for tenants and work more closely with public housing authorities and state rental assistance programs.

“We are a safety net hospital. We don’t have unlimited resources,” Sandel said. “But being able to avert an eviction is like avoiding a toxic exposure.”

“Without action from Congress, we are going to see a tsunami of evictions, and its fallout will directly impact the healthcare system and harm the health of families and individuals for years to come,” the letter stated.

Groups representing landlords urge passage of rental assistance too, although some oppose the CDC order. They point out that property owners must pay bills as well and may lose apartments where renters can’t or won’t pay.

“Not only does an eviction moratorium not address renters’ real financial needs, a protracted eviction moratorium does nothing to address the financial pressures and obligations of rental property owners,” Doug Bibby, president of the National Multifamily Housing Council, said in a Sept. 1 statement.

‘I want my life back’

Nicole MacMillan, 38, has already lost her apartment in Fort Myers, Florida where she moved with her two children last year. The former Wisconsin resident lost her job managing vacation rentals in March, and Florida’s unemployment system denied her jobless assistance. She switched her jobless application to Wisconsin in May and has been waiting ever since.

Nicole MacMillan lost her apartment in Fort Myers, Florida, where she moved with her two children last year. The former Wisconsin resident lost her job managing vacation rentals in March, and Florida’s unemployment system denied her jobless assistance. “I need a home for my kids again,” MacMillan says. The pandemic, she adds, “has ripped my whole life apart.”

“I actually contacted a doctor, because I thought mentally I can’t handle this anymore,” MacMillan said. “I don’t know what I’m going to do or where I’m going to go. And maybe some medication can help me for a little bit.”

But the doctor wasn’t accepting new patients.

MacMillan moved in with her grandparents in Grayslake, Illinois. Her children are staying with their fathers while she gets back on her feet. She recently started driving for Uber Eats in the Chicagoland area.

“I need a home for my kids again,” MacMillan said, fighting back tears. The pandemic “has ripped my whole life apart.”

“I just want my kids back. I want my life back. And I want some normalcy.”

Lareice, who requested to be identified only by her first name to protect her privacy, received rental assistance funds to stay in the three bedroom apartment she shares with her four children in Fond du Lac, Wisconsin. Performing her insurance company call center job from home more than doubled her electricity bill, she said, and required boosting her internet speed, making the work unaffordable. The 33-year-old left the job in June, and her state unemployment claim has since remained in adjudication.

With about $10 left in her bank account in August, she said she could not afford rent or her prescription medicine — so she skipped both. But rental assistance has now made her whole with her landlord as she starts a new job.

“They are not paying as much as my previous job,” Lareice said. “But I’m just gonna take what I can get so that me and my children won’t be out on the street.”

In Milwaukee, Community Advocates is helping the Pettigrews look for a more affordable apartment. Robert Pettigrew continues searching for safe work and looking to the future with a sense of resolve — and a request that no one pities his family.

“Life just kicks you in the butt sometimes,” he said. “But I’m the type of person — I’m gonna kick life’s ass back. I’m going to…do what I have to do to make sure that my family’s okay until they put me in the ground. And then after that, it’s up to God.”

This story was reported in collaboration with WPR, WBUR, Side Effects Public Media, NPR and Kaiser Health News. A version of this story ran on NPR.org and will be available from KHN.org. The nonprofit Wisconsin Watch (wisconsinwatch.org) collaborates with Wisconsin Public Radio, PBS Wisconsin, other news media and the University of Wisconsin-Madison School of Journalism and Mass Communication. All works created, published, posted or disseminated by Wisconsin Watch do not necessarily reflect the views or opinions of UW-Madison or any of its affiliates.

-

Legislators Agree on Postpartum Medicaid Expansion

Jan 22nd, 2025 by Hallie Claflin

Jan 22nd, 2025 by Hallie Claflin

-

Inferior Care Feared As Counties Privatize Nursing Homes

Dec 15th, 2024 by Addie Costello

Dec 15th, 2024 by Addie Costello

-

Wisconsin Lacks Clear System for Tracking Police Caught Lying

May 9th, 2024 by Jacob Resneck

May 9th, 2024 by Jacob Resneck