One Year After Shopko Went Bankrupt

Virtual town hall of ex-workers talk about impact of retail chain's 2019 shutdown.

The Shopko Hometown retail grocery store in Two Harbors, Minnesota, with a clearance sign posted in Jan. 2019. By Tony Webster, Generic (CC BY 2.0)

Just a day after Wisconsin banned face-to-face meetings of 10 or more people to help curb the spread of the virus responsible for COVID-19, more than 75 people gathered in cyberspace to mark a grim anniversary: Wednesday, March 18, one year to the day since the bankrupt Shopko retail chain announced it would close all its stores by the middle of the year in 2019.

The Wednesday evening gathering was intended to be an in-person town hall, to be held in a community center in the Green Bay suburb of Ashwaubenon. It was organized by three groups — Opportunity Wisconsin, which mobilizes state residents in opposition to the Trump administration’s economic policies and in support of policies to help the middle class; United for Respect, a nonprofit, multiracial organization promoting an economy that respects working people; and the Town Hall Project, a nonprofit that aims to foster dialogue between Americans and elected officials to advance democracy.

Organizers decided to pivot to an online get-together about 10 days ago — before public health directives curbing large gatherings to combat the spread of the illness caused by the coronavirus in Wisconsin.

For the organizers and for the participating former Shopko employees, the chain’s demise exemplifies a pattern of destruction in the retail industry by private equity investors like Sun Capital Partners, the firm that bought out publicly-held Shopko in 2005 and took it private. The transaction saddled Shopko with debt; Sun Capital extracted millions of dollars in fees over the next decade and a half, then liquidated it in bankruptcy court, eliminating 2,500 jobs in Wisconsin and 22,800 jobs nationwide. The workers who remained found themselves last in line as the company settled its debts.

The Shopko bankruptcy happened long before the current COVID-19 crisis, but organizers see larger lessons as talk in government turns to possible corporate bailouts in the face of economic turmoil.

“Opportunity Wisconsin has been squarely focused on growing the economy for low and middle class folks and expanding opportunity for all Wisconsinites, not just the wealthy few,” Westphal tells the Wisconsin Examiner. “We’ve seen how President Trump’s tax cuts have lined the pockets of the well-connected, while one in four Wisconsinites will ultimately see a tax increase. We’re demanding that any proposed emergency economic relief put working and middle class families first, instead of prioritizing the profits of Wall Street and big corporations.”

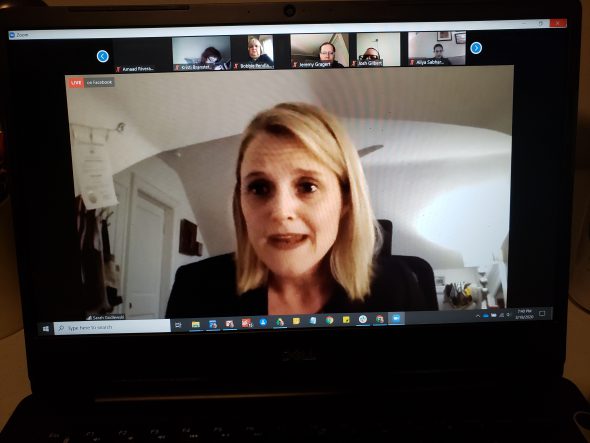

The former Shopko employees participating in Wednesday night’s virtual town hall were bolstered by a pair of public officials who clicked in to offer their support: Wisconsin State Treasurer Sarah Godlewski and Sen. Tammy Baldwin (D-Wis.). Baldwin, along with her staff, has been working with a final wave of displaced Shopko workers who didn’t receive severance pay they say they were promised in return for staying on through the liquidation process and postponing their search for new jobs.

The Shopko story

Wisconsin State Treasurer Sarah Godlewski speaks as part of a virtual town hall meeting Wednesday night conducted to discuss the experience of workers who lost their jobs when Shopko went out of business in 2019. Photo by Erik Gunn/Wisconsin Examiner.

Godlewski, who grew up in Eau Claire, described how Shopko for decades was woven into the fabric of small-town Wisconsin. “Shopko was at the heart of our community,” she said. “As a kid my mom would ask me if I needed anything for school. I would mention different supplies, and she would say, ‘OK, go put it on your Shopko list.’ It was never a shopping list, it was always a Shopko list.”

The bond communities had with the store made the chain’s demise “absolutely heartbreaking,” said Godlewski. “What Sun Capital Partners did to Shopko was completely reckless. It was reckless to our communities, it was reckless to their employees, it was reckless to Wisconsin, and it was reckless to our economy.”

Baldwin outlined Sun Capital’s actions. “The private equity owners loaded up the company with debt, and they used that to pay themselves additional hundreds of millions of dollars in fees and dividends,” she said. “These fees came at the expense of an investment in Shopko that it needed in order to stay competitive.”

The owners also sold Shopko’s real estate — the stores and the land on which they stood — then leased them back. “But we didn’t see the Shopko enterprise benefit from that sale,” Baldwin said. “Instead the executives and the investors are the ones who profited off of that looting.”

When Shopko filed for bankruptcy and ultimately liquidated after no buyers emerged to take over the company, “the private equity owners walked away relatively unscathed,” she said.

Baldwin sees a bigger story in Shopko’s collapse. “This is fundamentally about the rules of our economy — how does our economy reward work versus wealth,” Baldwin said. “Who owns a company, and what rights and responsibilities do owners have to their workers and their community? Why were the private equity owners of Shopko able to enjoy all the benefits of owning a company, but none of the responsibility? Why were the workers who created the profits for the company and dedicated, in some cases decades of their lives to serving its customers, left with nothing after the bankruptcy?”

Sen. Tammy Baldwin (D-Wis.) speaks as part of a virtual town hall meeting Wednesday night conducted to discuss the experience of workers who lost their jobs when Shopko went out of business in 2019. Photo by Erik Gunn/Wisconsin Examiner.

Those outcomes result from the current rules, Baldwin said. “If we are dissatisfied with these answers, which I think we can all agree on, it is up to us to change those rules.”

One way to change those rules, she offered, is the “Stop Wall Street Looting Act of 2019,” legislation she introduced last summer along with Sens. Elizabeth Warren (D-Mass.) and Sherrod Brown (D-Ohio). The bill would make private equity owners liable for the debt that they force a company to take on in an acquisition. “They will likely engage in far less risky behavior if they know they’re going to be responsible if the company goes bankrupt,” Baldwin said.

The act would also ban transfers from the acquired company to the private equity owners in the first two years of ownership, to stop them “from looting the company and starving it of investment.” In the event of bankruptcy, the bill “moves workers to the front of the line” and limits executive compensation.

In a presentation that followed Baldwin, United for Respect organizer Maria Garza described private-equity takeovers like Shopko’s as part of a recurring pattern, echoed in the stories of retailers like Sears and Toys R Us, but also surfacing in other industries, from health care to the media.

Front-line accounts

Then came the personal stories — three displaced workers, addressing the dozens gathered via telephone and computer screens to listen to them.

After working for nearly 12 years at a Shopko store in Grant County, Trina McInerney said, “Sun Capital left me jobless, with nothing.” She is currently employed in a temporary position that she hopes will become permanent, but McInerney has avoided retail work since losing her job at Shopko nine months ago with no severance pay. “The devastation was real, the heartbreak was real, having no income, losing your work family, losing your work dignity — all real,” McInerney said, tears palpable as they crept into her voice.

Jim Jordan, of Howard, near Green Bay, worked for more than 30 years at the company until Shopko’s closing forced him into retiring sooner than he had planned. Because he and his wife, Connie, had money saved and they had health insurance through her job as a public school employee, “it wasn’t as traumatic as it could have been,” he said.

But Connie Jordan pointed out that over the decades, her husband’s information technology job had meant that “he gave a lot — weekends, holiday nights. … He gave, and so many other people gave, and when Sun Capital decided to end all that, there were people that walked away with money — but it wasn’t Jim. It wasn’t his coworkers. And it wasn’t the people that we’ve known for many, many years at Shopko.”

Listeners following along added to the discussion in text form, holding a group chat in the same online platform. Former workers shared their stories and offered sympathy to the main speakers. Some checked in from out of state. “I still struggle with the loss of Shopko,” wrote a former employee from South Dakota. “I’m glad I joined this.”

The number of people who tuned in from all over was striking, says Westphal, the moderator. “It was a great reminder of the power of community, but also a sobering reminder of just who will continue to suffer if Wisconsin workers are left hanging in the coming weeks and months.”

On the main screen, the final speaker was Linda Parker of Columbus, Wis. Parker was a multi-store manager for Payless Shoes, which had a mix of freestanding stores and store departments inside Shopko stores. She, too, got no severance pay, she said, and while her husband is retired, “currently I’m doing three part-time jobs — they don’t come up to what I was earning at Payless.”

The losses were economic, but also social, said Parker, calling her coworkers in her former job a “second family” because “you spend all your waking hours with these folks.”

She’s been unable to find full-time work, she said, and the part-time jobs lack benefits. And then she mentioned, just in passing, the very reason that everyone on this evening was gathered in the safety of their homes, connected through the internet instead of face to face: COVID-19.

“I didn’t just lose my job, my work family, I also lost my health insurance,” Parker said. “Now that we’ve got this big bubble over everybody’s head, it’s that much more of an anxious situation.”

She didn’t stop there, however. Parker echoed the rallying cries of those who had spoken before her.

“Holding Wall Street and private equity and hedge fund billionaires accountable is crucial,” she said. “It’s just going to get worse. They feel no empathy for us, they feel no guilt over what they’re doing. … It’s time to take action and do something to stop these horrible business practices.”

Reprinted with permission of Wisconsin Examiner.