Who’s Best on Budget and Taxes?

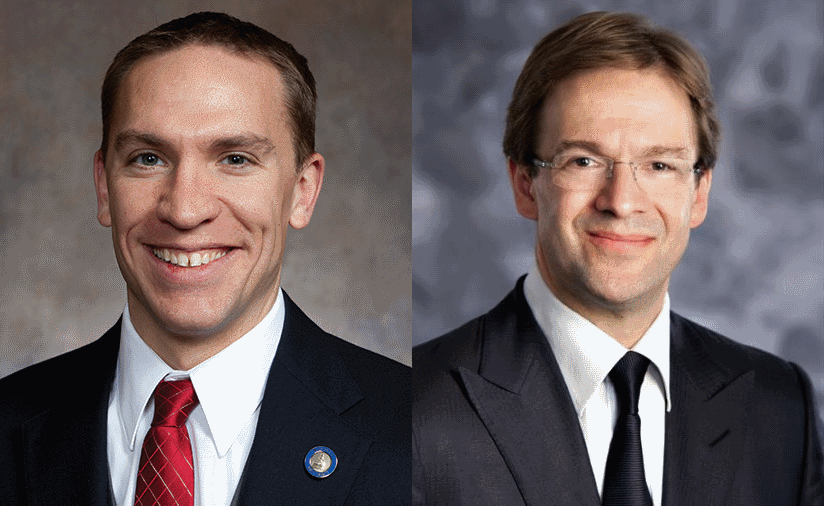

Did Abele clean up mess left by Larson? Or did he use budget tricks, as Larson contends?

Chris Abele‘s Views:

The Milwaukee County I inherited five years ago from Scott Walker and Chris Larson was near fiscal collapse. At the time, the Public Policy Forum was actually questioning the viability of having a Milwaukee County government.

After years of budget decisions driven by wishful thinking, campaign promises, and favors to special interests, Milwaukee County was in desperate need of a serious, independent manager who would come in and make the tough choices needed to stop accumulating debt and decreasing services. I made those tough choices and this year the same Public Policy Forum noted the “remarkable turnaround” the County has experienced in the past five years.

How did we do it? We’ve built an incredible team over the past five years, and multiple departments are setting all-time records. I have no doubt that, with an unlimited budget, we could do even more. But the reality is that we have a finite budget and it’s funded by your tax dollars.

I also believe that with sound fiscal management we don’t have to ask working families to pay more than their fair share. That’s why for the five years I’ve been in public office, I have never introduced an increase to the property tax and have attempted to work with the members of the County Board to reduce the tax increases they supported — tax increases that can prevent many working people from buying a home.

Unlike my opponent, I’m not going to ask working families to shoulder the burden of paying the County’s bills by proposing to triple the County’s sales tax. Asking families to pay more for their kids’ school supplies, clothes, and shoes isn’t a fair — or smart — way to balance our budget.

Before we think about increasing taxes on working families, we need to tell people and corporations who have the ability to pay that refusing to pay their property taxes isn’t an option anymore. That’s the way only we can ensure that the County has the funds to support housing and mental services as well as pay for our world-class parks system.

Unfortunately, we have found that there are suburban property owners – often landlords and corporations – have found ways to avoid paying their property taxes, believing that no one is watching. Well, we’re watching now and I want to put an end to it. I am working with a bipartisan coalition of legislators in Madison to improve our debt collection efforts.

For the past five years, my team has been smart with your money so we can continue to invest in our County’s amazing resources, increase services and lower the deficit – all without raising taxes. But I’m just getting started.

Chris Larson’s Views:

It’s time to end the dishonest, Scott-Walker-style tax gimmicks used by the current Milwaukee County Executive. The status quo isn’t working and our parks, transit system, and other crucial services are clearly suffering.

The same trick has been used year after year: Just like Scott Walker, the current County Executive proposes an unrealistic budget that cuts services and claims to freeze property taxes, then he waits for the County Board to fix it. Months later, he embraces the higher property tax and the charade starts anew.

Milwaukee County homeowners are paying too much in property taxes, which go up almost every year. I have a better plan to pay our bills while also reducing property taxes. I’m proposing to shift some of the funding for Milwaukee County government from property taxes by increasing the sales tax by one cent on the dollar. This will generate new revenue, establish dedicated funding for our parks, transit, and public safety and half the funds will immediately reduce the property tax levy.

When Milwaukee County voters approved a one-cent sales tax in 2008, experts estimated this would generate $130 million in annual revenue for Milwaukee County. This would be split between $65 million for property tax reduction and $65 million in dedicated funds for our parks, transit, and public safety (by the way, we’re one of the last major metropolitan areas in the country not to have dedicated funding).

Some have called the sales tax regressive so we looked into it. It is true in most other states but Wisconsin is actually unique because so many things are sales tax exempt. Think about what it would be like to be in poverty. What would you spend most of your money on? Essential needs like rent, groceries, medicine, medical care, gasoline, and services are all exempt from sales tax under Wisconsin law. On the flip side, working families would stand to benefit the most from from our plan, because it will improve access to more jobs through a robust transit system, higher quality parks, and a safer community. Overall, it’s a net benefit for working families.

Shifting Milwaukee County’s revenue sources in this way will also move more of the costs to out-of-town visitors who benefit from our community but currently don’t pay their fair share to support them. It’s estimated that one-third of the revenue raised from the sales tax comes from folks from outside the County.

How do we make this happen? It’ll start by building a coalition of other counties across the state that are also starved for revenue after Walker’s cuts to local services. With this coalition of leaders, we’ll ask the state for flexibility and local control. If it requires a referendum, I’m open to that. Our referendum passed in 2008 and I know neighbors are ready for honest, long-term solutions. We’ll talk more about this in our annual listening sessions in each municipality.

That’s what we’re offering: clear, honest, open discussion about our community’s future. Hope you’ll join us.

Chris vs Chris

-

What My Opponent is Most Wrong About

Mar 30th, 2016 by Chris Abele and Chris Larson

Mar 30th, 2016 by Chris Abele and Chris Larson

-

Who Works Better with Other Governments?

Mar 23rd, 2016 by Chris Abele and Chris Larson

Mar 23rd, 2016 by Chris Abele and Chris Larson

-

How to Handle Mentally Ill and Homeless

Mar 17th, 2016 by Chris Abele and Chris Larson

Mar 17th, 2016 by Chris Abele and Chris Larson

I’m with Larson on this one. Pursue policies which keep low income folks above water and make it possible for low to middle income people to reach jobs and other essential destinations.

Every bit helps when it comes to lowering property taxes but $65 million isn’t very much when there are nearly 1 million people in the county. Wisconsin has some of the highest property taxes nationally and Milwaukee has some of the highest in the state. I’m paying I think 2.25%. I’d gladly pay more in sales tax than property tax. I have no problem buying less but I have no choice but to pay my property tax.

This is a major factor why many retired people end up leaving. If you’re on a very limited SSI income and live in a decent neighborhood, its going to be hard to keep living. Being frugal does no good in this county.