Wisconsin Not High in Taxes, Spending

Ranks 25th in spending and 21st in taxes and fees per capita.

Despite claims that Wisconsin is a high-spending state, it is actually close to average in many measures of revenue and spending among the states, according to new figures from the Census Bureau.

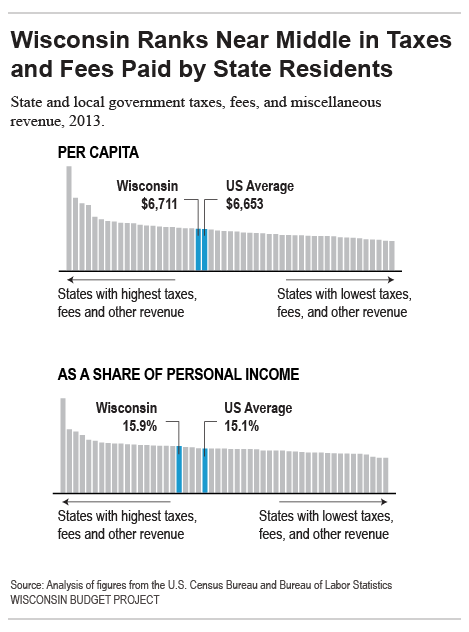

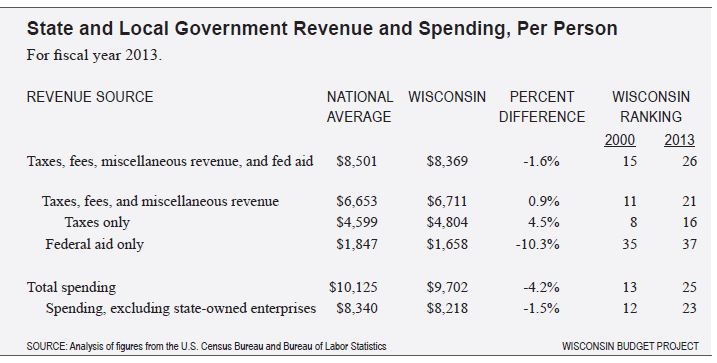

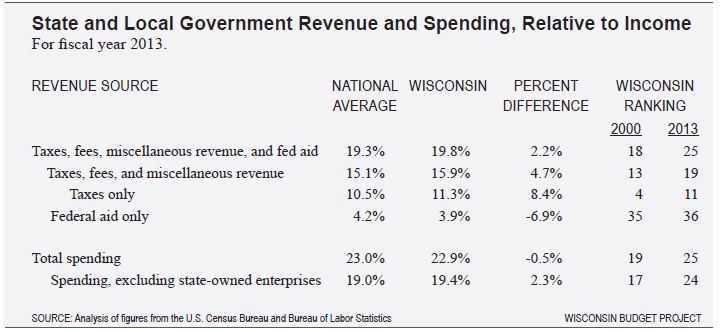

Wisconsin ranked 21st out of the 50 states in the amount of state and local taxes, fees, and other revenue collected per person in fiscal year 2013. Measured as a share of personal income, Wisconsin ranks 19th among the states in taxes, fees, and miscellaneous revenue.

Some policymakers focus on Wisconsin’s ranking on taxes alone when evaluating its revenue compared to other states. But focusing just on taxes means that fees and other charges, which come from residents’ pockets much like taxes do, are not taken into account. Combining taxes with fees and other revenue gives a broader and more complete measure of the money that state and local governments in Wisconsin collect from their residents.

The average amount state residents paid in taxes and fees is close to the national average. In 2013, Wisconsin residents paid an average of $6,711 in taxes, fees, and other charges to state and local governments, $57 higher than the national average. State residents paid 15.9% of personal income in taxes and other revenue, above the national average of 15.1%.

Wisconsin’s rankings in revenue and spending as a share of income have fallen as well. Measured relative to income, the state ranked 19th in taxes, fees, and miscellaneous revenue in 2013, down from 13th in 2000, and 25th in total spending, down from 19th.

Because per capita income in Wisconsin is well below the national average, we typically rank higher when revenue and spending are measured on that basis.

Wisconsin policymakers who advocate for tax cuts should know that Wisconsin governments are already close to the national average in the amount of taxes and fees they collect from residents. Additional tax cuts could jeopardize Wisconsin’s public investments in high-quality education and health care, and make it more difficult to invest in public safety and transportation in our communities. That would hurt our economy in the long run, since those are the very things our businesses and families need to thrive.

Tax HELL Wisconsin!???

It’s not what you pay, it’s what you get for what you pay. With a legislature that is more interested in creating problems, such as kicking the can down the new road, by borrowing for them instead of finding the sustainable revenue stream to pay for them. I think the taxes are still to high. Cuts to education, mass transit and tax relief for the already rich don’t speak to good tax policy regardless of the rates