Wisconsin Taxes and Inequality

Have Walker’s tax changes increased or decreased inequality in the state?

Growing income inequality in the US is raising increased concern. Is the middle class an endangered species? Will children born poor find it increasingly difficult to work their way into the middle class?

In the next few years Gov. Scott Walker and the Republican-led legislature will be making major decisions about its tax structure and whether the changes increase or decrease income inequality in Wisconsin.

Taxes can be classified as regressive, neutral, or progressive. A tax is regressive if the effective rate goes down as income increases, meaning the wealthy taxpayer pays a smaller percentage of income than a poor person. They are neutral if the rate does not change with income, and progressive if the effective rate increases with income.

Generally speaking, regressive taxes make income inequality greater, progressive taxes reduce it, and neutral taxes have no effect. The organization that has done the most extensive analysis of how state taxes redistribute income upward or downward is the Institute on Taxation and Economic Policy (ITEP).

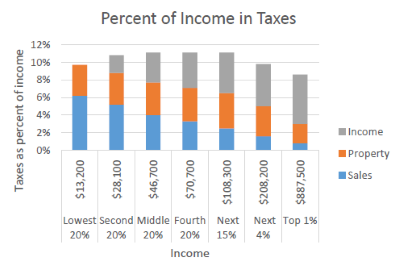

Like most states, Wisconsin’s state and local governments are mainly funded by three taxes: income, property, and sales. The chart below shows ITEP’s analysis of the percentage of their income Wisconsin families of various income levels pay in taxes. It divides the lower 80 percent of taxpayers into four equal-sized groups based on income. The top fifth is further subdivided into three groups, the lowest 15 percent, the next 4 percent and the top 1 percent.

Wisconsin’s income tax is progressive. It remains so even after a decrease in the earned income tax credit early in the Walker administration.

Wisconsin’s property tax is fairly neutral. At the highest level it becomes somewhat regressive because very wealthy people spend a lower percentage of income on housing.

Wisconsin’s sales tax is strongly regressive, despite exempting food and most services. Most of the tax paid by lower income people is for the sales tax, while it’s a tiny portion of taxes paid by the wealthy.

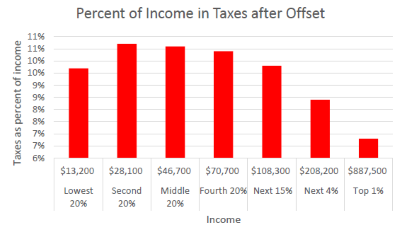

Taxpayers who itemize are able to deduct their property and income taxes from their federal income taxes. The value of this offset is greater for higher income people because their property and income taxes are likely to be higher and because they’re more likely to itemize deductions. The next chart shows ITEP’s estimate of the effective taxes people pay at different income levels. Wisconsin’s tax system is dome-shaped: it is slightly progressive at low incomes, essentially flat through the middle 60 percent of taxpayers, and regressive at the highest incomes.

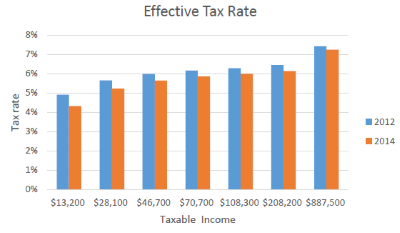

During the Walker term, there were several changes in the state income tax. Walker seems to have been sensitive to the charge his changes were favoring the wealthy. Rates were reduced somewhat more at the lower brackets than at higher ones. The chart below shows the before and after taxes that people at various income levels would pay.

As can be seen, effective rates dropped less at higher incomes than at lower incomes. In isolation, this change would have made the Wisconsin income tax slightly more progressive.

However, the other effect of the change is that the income tax collects less money. So how did the state make up for this loss? I will let the pro-Walker MacIver Institute, explain how:

An in-depth analysis by the MacIver Institute of local and state savings brought on by Wisconsin 2011 Act 10 has found that tax payers have saved $2.7 billion since the law was enacted….. Savings continued to increase over the last 12 months and now total just under $3 billion… A majority of state and local savings were due to state employees contributing half of their pension contributions and a minimum of 12.6 percent of their health insurance premiums. These minor changes for state employees have helped Wisconsin not only balance its budget, but cut income taxes by nearly $650 million and property taxes by $100 million over the next two years.

In other words the reduction in income tax rates was largely funded by cuts to compensation of state and local public employees. Thus the funding source for the tax cuts was a group of middle-income people. Quoting the state budget office, the Journal Sentinel said Act 10 reduced the take-home pay of the average state worker making $50,000 a year by $4,228. By comparison the Walker income tax cuts would save this person $172.

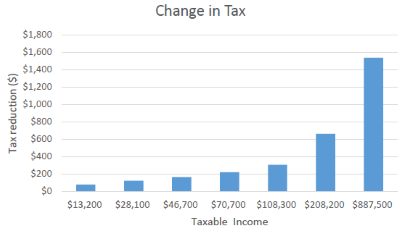

Like most reductions in income tax rates the benefits of this change were heavily skewed towards wealthier taxpayers. The top 1 percent of taxpayers received over 7 percent of the benefit, while the top 20 percent received about 43 percent.

Thus, the combination of Act 10 and the income tax changes resulted in a substantial upward redistribution of income from a group of predominantly middle income people to very wealthy people, thereby increasing income inequality.

Walker and the legislature could have chosen a less top-heavy use for the Act 10 savings. One example is a tax credit that applies equally to everyone. Another would have used the savings to increase middle-income jobs, such as those for more teachers or police officers.

Gov. Walker has made it clear he will make proposals for changes in Wisconsin tax laws. During the campaign he committed to further reductions in the income and property taxes and to not support an increase in the sales tax. But in at least one interview he speculated about eliminating the income tax entirely.

Mary Burke learned to her regret the advantage Walker gained by keeping his proposal vague. Apparently reacting to Walker’s speculations about eliminating the income tax and calculations that one way to do that would be to increase the sales tax to 13 percent, in an interview she contended that Walker planned to do that. For her trouble, PolitiFact rated her statement as “pants on fire.”

A recent report from a series of public “workshops,” chaired by Lt. Governor Rebecca Kleefisch and Revenue Secretary Rick Chandler avoids specific recommendations. Instead it summarizes comments from the workshops in a list of five concerns, headed by the property tax and the personal income tax. The third major source of state revenue, the sales tax, is not included. (The other three concerns are tax law complexity, small business taxes, and cost of government.) This could give credibility to speculation that Walker will propose decreasing the first two taxes by increasing the sales tax, in the process making Wisconsin taxes more regressive.

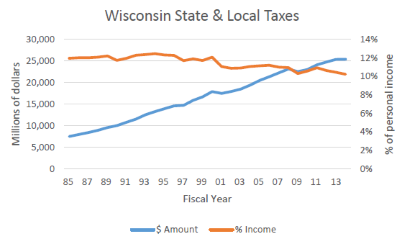

The Kleefisch report seems intent on promoting the notion that Wisconsin’s tax burden has increased over the years, even though the figures it includes show the ratio of taxes to personal income dropping from 12.2 percent in fiscal year 1991 to 11.0 percent in fiscal year 2010. Yet it claims that between 1990 and 2011 total Wisconsin state and local taxes grew at an annualized rate of 4.3 percent while personal income grew 3.9 percent per year. If true, taxes as a fraction of personal income would have grown instead of declining.

Will Walker’s tax agenda increase income inequality? There are reasons to expect this. The governor swims in an intellectual sea that is overwhelmingly hostile to progressive taxes. Making Wisconsin taxes more regressive would likely improve Wisconsin’s ranking from organizations like the Tax Foundation, ALEC, and of the others that purport to rate the “business friendliness” of states. Locally the conservative Wisconsin Policy Research Institute (WPRI) commissioned a report advocating expanding the sales tax to additional items, such as food and gasoline in order to reduce the income tax.

At the same time, Walker is a very canny politician and seems well aware of the danger to his national ambitions if he is accused of increasing Wisconsin’s income inequality. Sensitivity to the charge of redistributing income upwards was likely a consideration in deciding to reduce lower-bracket income tax rates more than upper-bracket rates. The Kleefisch report also reflects this same sensitivity, by including a chart showing the distribution of benefits to different income levels using income increments of $10,000. This approach takes advantage of the fact that there are a lot more taxpayers in Wisconsin making between $40,000 and $50,000 than those between $240,000 and $250,000.

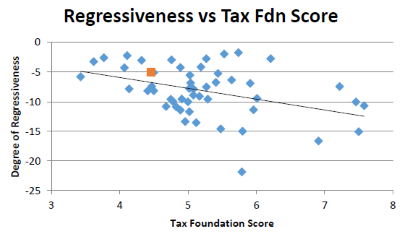

Every state’s tax system is regressive when taken has a whole, but some much more than others. To get an idea of the magnitude, I calculated the slope of a line drawn through ITEP’s seven income categories. If the slope were positive, higher income taxpayers would pay a higher portion of their income than lower income taxpayers. As you can see in the chart to the right, no state is at 0 degrees of regressivity and Wisconsin (marked in orange) is about five percent regressive.

The lower a state falls on the vertical scale, the more regressive its tax system: the lowest state is more than 20 percent regressive. Wisconsin, while regressive, is still less so than most.

The horizontal scale shows the score the Tax Foundation gave states in its most recent ratings. Since the foundation is open in its dislike of progressive income taxes, it is no surprise that states with more regressive taxes as a group score better.

Data Wonk

-

Scott Walker’s Misleading Use of Job Data

Apr 3rd, 2024 by Bruce Thompson

Apr 3rd, 2024 by Bruce Thompson

-

How Partisan Divide on Education Hurts State

Mar 27th, 2024 by Bruce Thompson

Mar 27th, 2024 by Bruce Thompson

-

Will Wisconsin Supreme Court Legalize Absentee Ballot Boxes?

Mar 20th, 2024 by Bruce Thompson

Mar 20th, 2024 by Bruce Thompson

How does ITEP’s data on sales tax as a percent of income for the lowest 20% explain how it’s over 6% when most sales tax in the state is below that amount? Even if they spent every dollar they had on items with sales tax, they’d have to somehow manage to only spend it on the few items with tax over 6%. At first glance, something looks fishy here… which makes me question all their data.

Bruce, besides my reservations on numbers, I take exception to the idea that Walker is trying to create a more regressive tax system when you repeatedly show he’s done the opposite. Anything else is just conjecture.

And really, I think we all know that when one small group pays the vast majority of income taxes that any change to their rates will have a disproportionate effect on the contribution from that group relative to others. This holds true even if the other groups have a larger percentage change. It’s an old story that I’m sure is getting less and less traction.

Walker and the GOP will raise and/or expand the sales tax to offset an income tax reduction – where else is the money going to come from? I personally heard Ex-Assembly Majority Leader Bill Kramer say that back in September 2012, and I don’t believe you get to be the Majority Leader without agreeing w/ the rest of the party on major issues like this.

Besides, everyone wins w/ trickle-down economics: http://www.theonion.com/articles/reaganomics-finally-trickles-down-to-area-man,2302/

I really hope the sales tax isn’t increased. That’s only going to hurt the poor and middle class.

Andy,

Good questions, and I may have been too brief in my summary.

Under what I called Sales Tax, ITEP lists three things:

General Sales—Individuals 2.4%

Other Sales & Excise—Ind. 2.2%

Sales & Excise on Business 1.6%

Together they add to 6.2%.

Bruce

To support what Andy is saying, look again at the “Change in Tax” graph and calculate each income tier’s tax savings as a percentage of their income. It would show that the lower income earners are getting the biggest break. Saving an additional $1,500 in taxes when you earn $887,500 is no real lessening of burden.

Great analysis Bruce!! The wealthy under Walker and Republicans not only pay a smaller percentage of their income in taxes than the poor and middle class. They also receive the largest portion of tax cuts, and data shows that such dollars do not recycle back into the local economy compared to a larger middle class tax cut. Theres only so many cars, lawn mowers, TVs and computers you can buy when rich. When tax cut windfalls go to the rich, they sock the money away in investments/trusts, or consumer spending outside the State of Wisconsin, namely travel. For Andy’s question, Bruce is again correct and Andy is very wrong. Under category of Sales taxes is excise taxes These are flat tax amounts, and two in particular impact heavily in consumer spending for lower wage earners: the gas tax and the tax on tobacco. When you factor those revenues into the Sales tax, which in Milwaukee county exceeds 6%, and Milwaukee having the largest percentage of low income folks in state, its actually surprising the 6.2% is not a higher number for the lowest bracket. TYPO: last sentence of par. 3, you meant to say progressive and instead have regressive typed a second time.

Jacob,

You are right that, taken in isolation, the changes in the income tax make it slightly more progressive. That is clear from the graph titled “Effective tax rate.” The percentage rate dropped less for the top1% than the bottom 20%. When looking at the tax system as a whole, however, there is reason to believe the changes will end up resulting in an upward redistribution of income:

1. Who pays and who benefits. If we regard the change as funded by state employees, it can be considered a redistribution from middle income taxpayers to those making more money.

2. If the result is that the income tax becomes a smaller share of the Wisconsin tax package, the overallWisconsin tax package is likely to become more regressive, since the income tax is the only progressive part of it.

I should point out, however, that DOR projections show the income tax growing from 50.6% in FY14 to 52.2% in FY17.

“Act 10 reduced the take-home pay of the average state worker making $50,000 a year by $4,228.”

How much was gained by not paying union dues? I assume the answer is not even close to 4K, but I am curious where that number falls.

Thanks.

A couple of things to keep in mind when evaluating the tax situation in Wisconsin:

– Our income taxes, corporate taxes and property taxes are relatively high compared to other states. The double whammy in this is that while you get to deduct these taxes on your Federal return they are completely eliminated as a deduction if a person is subject to Alternative Minimum Tax (AMT). While most people don’t understand the AMT I can tell you that as a CPA it is usually people with family incomes ranging between $150,000 and $300,000 who get hit with that. The IRS also now phases out the value of itemized deductions on higher income people. Most of the super rich (the ones who receive income and not off of investments) don’t pay AMT because their effective tax rate is above the AMT rates even with their deductions.

– I don’t think the Income tax in Wisconsin can ever be as progressive as some would want. With the top Federal rate now at 39.6% there is only so much money for the States to be able to take. Keep in mind the current Republicans didn’t even have the stomach to bring the top rate anywhere near the 6.75% it was during the vast majority of Doyle’s administration.

– The most regressive tax Wisconsin has is the sales tax and that’s the one tax we have that is lower than most. It’s also the one that many would love to tap to either fund the cultural assets of the area or build an arena.

– Sure, we can tack on excise taxes, but those are typically “do-gooder” types of taxes that are pushed to discourage a particular behavior. For example, if their was a proposal to increase the cigarette tax I don’t know how many Democrats would be worried about the regressive nature of that tax.

– As far as Rep. Zepnick’s comments on the rich investing their money: That investment is needed in the private sector and many believe that the private sector is better and more efficient than you might be in investing those funds.