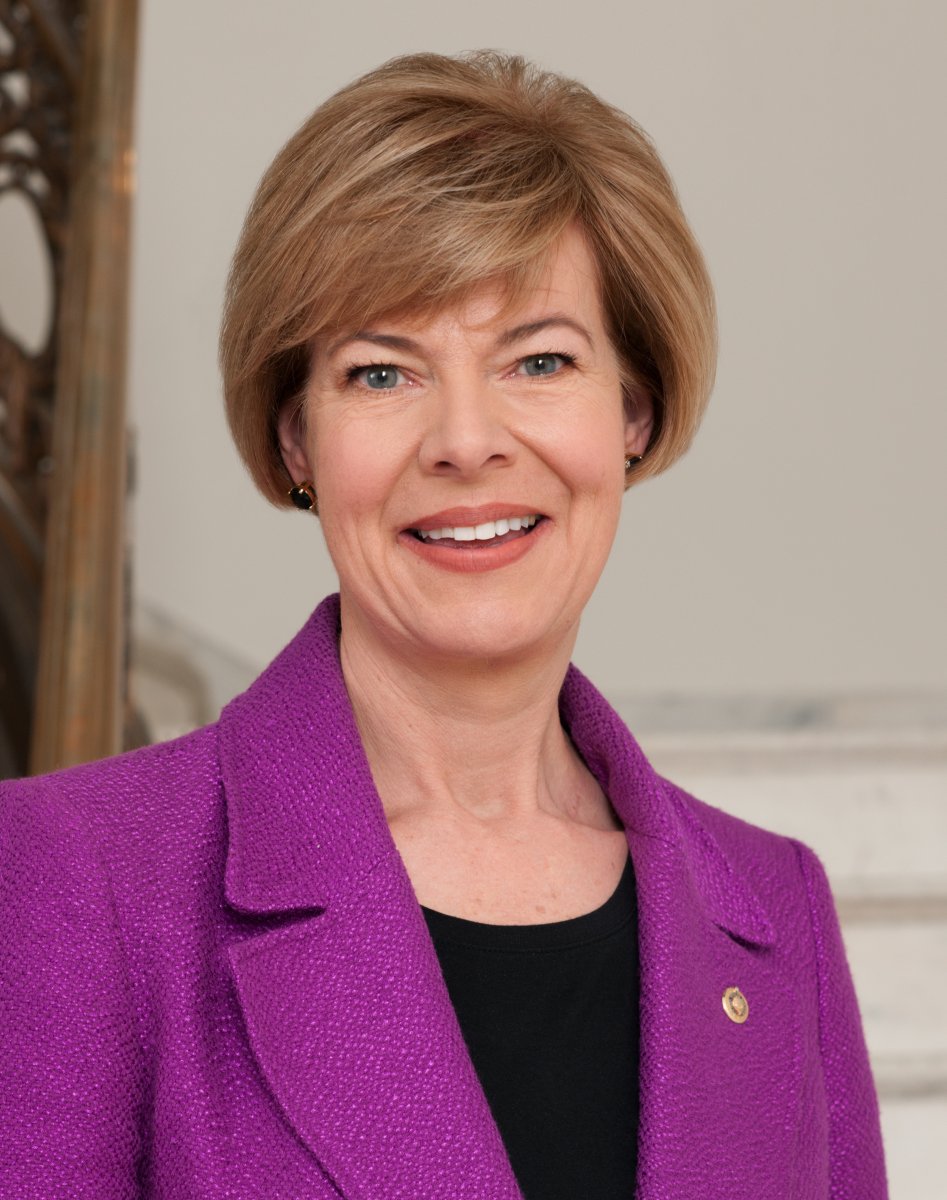

Senator Baldwin Reintroduces Legislation to Lower Health Care Costs & Expand Access to Insurance for Millions More Americans

An estimated 8.9 million Americans have lower premiums thanks to enhanced tax credits passed in Inflation Reduction Act & the American Rescue Plan Act

WASHINGTON, D.C. – U.S. Senator Tammy Baldwin (D-WI) joined Senator Jeanne Shaheen (D-NH) to reintroduce the Improving Health Insurance Affordability Act, legislation to make permanent enhanced tax credits that led to record enrollment in the Affordable Care Act (ACA) marketplace, while reducing health care costs for millions of additional Americans.

“Thanks to enhanced tax credits, countless American families have access to quality health coverage on the insurance marketplace,” said Senator Baldwin. “We need to protect and expand access to affordable health insurance. By making these tax credits permanent, millions of Americans can rest assured they can continue to find the quality health care coverage they need, at a price they can afford.”

The Improving Health Insurance Affordability Act would make permanent premium tax credits for individuals signing up for health care coverage through the ACA marketplace, tax credits that were improved and extended through the Inflation Reduction Act. Those enhanced tax credits increased the value of the financial assistance available to people with incomes between 100 and 400 percent of the federal poverty level (FPL) while expanding eligibility for premium tax credits to include individuals with incomes above 400 percent of FPL. The bill would also make the second-lowest-cost Gold plan the benchmark plan upon which premium tax credits are based, which helps substantially reduce deductible and out-of-pocket costs for families of all incomes. Finally, the bill would also increase the value of cost-sharing reduction (CSR) assistance for people with incomes between 100 and 250 percent of FPL (who are already eligible), while also expanding eligibility for CSR assistance to people with incomes up to 400 percent of FPL.

According to the most recent data, nearly 15.9 million Americans have signed up for 2023 individual market health insurance coverage through the Marketplaces since the start of the 2023 Marketplace Open Enrollment. That record-breaking enrollment represents a 13% increase over last year. According to a June 2022 report from the Department of Health and Human Services, absent the enhanced tax credits, 8.9 million Americans stood to have their tax credits reduced and 1.5 million would lose their subsidies entirely. Similarly, a February 2021 Urban Institute analysis of changes included in this legislation indicates that this bill could significantly reduce out-of-pocket costs for consumers newly eligible for CSR assistance or heightened levels of CSR assistance through lower deductibles.

Full text of the bill is available here.

An online version of this release is available here.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by U.S. Sen. Tammy Baldwin

Video: Senator Baldwin Blasts Republicans’ Disastrous Budget Bill that Slashes Medicaid & SNAP, Rigs Tax Code for the Wealthy

Jun 30th, 2025 by U.S. Sen. Tammy BaldwinBaldwin: “This bill will make it harder for working families to have the opportunity to get ahead. Harder for parents to get their kids health care. Harder for families to put food on the table.”

On 3rd Anniversary of Roe Being Overturned, Baldwin, Blumenthal, and Murray Lead Senate Dems in a Bill to Restore Abortion Access Nationwide

Jun 24th, 2025 by U.S. Sen. Tammy BaldwinWomen’s Health Protection Act comes as Trump and Congressional Republicans move to restrict a woman’s right to choose and toward a national abortion ban