Heartland Sponsors ‘Money Path’ to Help Teens Plan Their Financial Futures

Money Path, Sponsored by Heartland Advisors, Launched by SecureFutures to Help Wisconsin Teens Plan Their Financial Futures

Milwaukee, October 29, 2018—Heartland Advisors is proud to support today’s official launch of Wisconsin-based nonprofit SecureFutures’ new web-based application, Money Path. Since 2006, volunteers with SecureFutures have visited Wisconsin schools to help prepare 16- to 18-year-olds on a range of real-life money matters. Money Path, Sponsored by Heartland Advisors, is a high-impact new tool to give teens and young adults a glimpse of their financial futures.

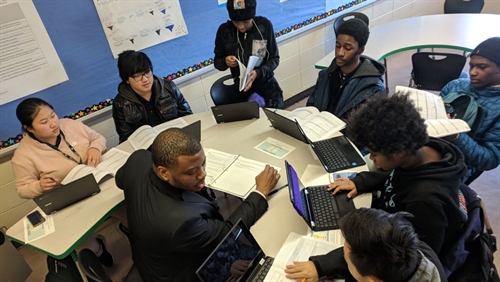

In classroom sessions facilitated by SecureFutures volunteers, Money Path poses a series of “What If?” scenarios relating to college, student loan debt, careers, starting pay, budgeting, and saving decisions—all fitting together to help students see how post-high-school financial decisions could impact their futures.

Prior to its official launch this week, SecureFutures beta-tested Money Path in local high schools, resulting in overwhelmingly positive feedback and high demand upon its launch. The application boasts fully integrated databases for career, college, and starting-pay choices, allowing users to receive accurate data to realistically visualize potential scenarios. It also allows for financial goal planning through simulations based on income, lifestyle saving, and spending choices.

“This powerful application would not be possible without the support of Bill Nasgovitz and Heartland Advisors,” said Brenda Campbell, President and CEO of SecureFutures. “Through Money Path, students can determine if their saving habits and lifestyle choices will provide a financially sound future. Based on the results, they are then prompted to revise their goals and determine exactly what steps they need to take to realize their full potential. Enabling students to do so in a classroom environment, before the full impact of their actions is realized, is an invaluable exercise.”

Bill Nasgovitz, founder and chairman of Heartland Advisors, is a longtime supporter of youth financial literacy in the region. He has served as a member of SecureFutures’ Advisory Council since the organization’s inception.

“Heartland Advisors’ support of this app reflects our deep roots in the Midwest and Bill Nasgovitz’s passion for and commitment to arming local community members with the financial education and tools necessary to address the socioeconomic issues we see around us,” said Nicole J. Best, CPA, senior vice president, chief financial officer, and chief administrative officer at Heartland Advisors.

Best is a member of SecureFutures’ Advisory Council, former Board Director, and has held multiple leadership roles within the organization, including Board Chair and Treasurer. Both she and Nasgovitz have been active participants in championing SecureFutures’ goals since its early years.

SecureFutures is a 501(c)3 nonprofit agency based in Milwaukee. Formerly known as Make a Difference–Wisconsin, the organization changed its name in 2017 to more clearly reflect its focus on youth financial literacy and preparedness. In addition to its classroom-based programs, SecureFutures hosts a signature Investment Conference each spring.

About Heartland

Established in 1983, Heartland Advisors, Inc. is an independently owned equity value investment manager based in Milwaukee, Wisconsin. As of September 30, 2018, the Firm managed approximately $1.7 billion. The Heartland family of value-driven, actively managed portfolios includes distinct U.S. and international strategies, offered through four mutual funds and separately managed accounts. Learn more at heartlandadvisors.com.

About SecureFutures

SecureFutures empowers students with life-changing financial education and coaching. SecureFutures was founded as Make A Difference–Wisconsin in 2006 and remains dedicated to strengthening our communities by ensuring every teen is confident and capable when it comes to managing money. Its collaborative network of supporters, volunteers and educators have worked to improve financial futures for more than 62,000 teens. Learn more at securefutures.org.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.