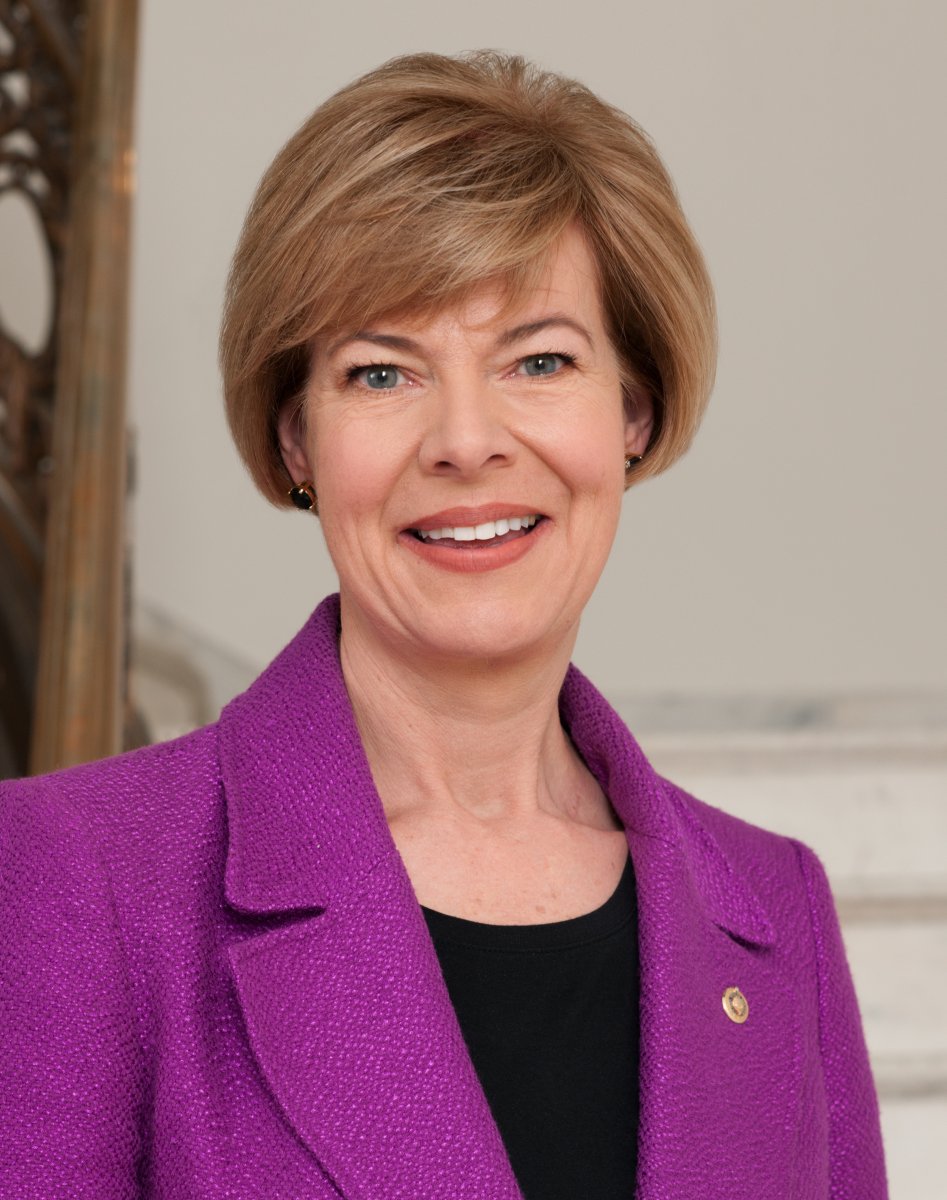

Baldwin Calls on Senate to Pass Bipartisan Tax Cut for Wisconsin Families and Businesses

Bipartisan plan restores major provisions of Child Tax Credit, supports Made in Wisconsin manufacturers

WASHINGTON, D.C. – Today, Senator Tammy Baldwin (D-WI) released the following statement in support of the bipartisan Tax Relief for American Families and Workers Act, House-passed legislation that would cut taxes for Wisconsin parents by expanding the Child Tax Credit, support Wisconsin manufacturers that invest in American innovation, and bolster Wisconsin’s Main Streets and small businesses.

Cut Taxes for Working Families with an Enhanced Child Tax Credit

- Expand access to child tax credit: Phased increase to the refundable portion of the child tax credit for 2023, 2024, and 2025. Approximately 224,000 children in Wisconsin would benefit from the child tax credit expansion in the first year, according to the Center on Budget and Policy Priorities.

- Eliminate penalty for larger families: Ensures the child tax credit phase-in is applied fairly to families with multiple children.

- One-year income lookback: Creates flexibility for taxpayers to use either current- or prior-year income to calculate the child tax credit in 2024 or 2025, similar to bipartisan action taken six times in the past 15 years.

- Inflation relief: Adjusts the tax credit for inflation starting in 2024.

Cut Taxes for Made in Wisconsin Manufacturers

- Research & Development (R&D): Encouraging American innovation and improving our competitiveness through R&D expensing so businesses of all sizes can immediately deduct the cost of their U.S.-based R&D investments over five years.

- Interest deductibility: Continues flexibility for businesses forced to borrow at higher interest rates to meet their payroll obligations and expand their operations.

- 100 percent expensing: Restores full and immediate expensing for investments in machines, equipment, and vehicles.

- Taiwan double tax relief: Strengthens America’s competitive position with China by removing the current double taxation that exists for businesses and workers with a footprint in both the United States and Taiwan.

Build Up Main Street and Rebuild Communities Struck by Disasters

- Expand small business expensing cap: Increases the amount of investment that a small business can immediately write off to $1.29 million, an increase above the $1 million cap enacted in 2017.

- Cut red tape for small businesses: Adjusts the reporting threshold for businesses that use subcontract labor from $600 to $1,000 and index for inflation – the first update to the threshold since the 1950s.

- Help families get back on their feet with disaster tax relief covering recent hurricanes, flooding, wildfires, and the Ohio rail disaster.

Boosting Affordable Housing

- Increases supply of low-income housing: Enhancing the Low-Income Housing Tax Credit, a public-private partnership with a proven track record, with increased state allocations and a reduced tax-exempt bond financing requirement.

Eliminate Fraud and Waste by Ending the Employee Retention Tax Credit Program

- Saving taxpayer money: Saving over $70 billion in taxpayer dollars by accelerating the deadline for filing backdated claims to January 31, 2024 under the COVID-era employee retention tax credit – a program hit by major cost overruns and fraud.

An online version of this release is available here.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. While it is believed to be reliable, Urban Milwaukee does not guarantee its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by U.S. Sen. Tammy Baldwin

Senator Baldwin Hits Trump on $600 Million Cuts to Public Health Funding, Including Disease and Hiv Prevention

Feb 11th, 2026 by U.S. Sen. Tammy BaldwinRFK, Jr. and Trump targeted only states and communities governed and represented by Democratic leaders and said these lifesaving health initiatives “do not reflect [their] priorities”

Baldwin Leads Bill to Expand Affordable Housing, Crack Down on Wealthy Investors Who Buy Up Single-Family Homes

Feb 11th, 2026 by U.S. Sen. Tammy BaldwinLegislation would help create approximately three million affordable housing units

US Rep Rosa DeLauro put out a release stating the difference between this legislation and the American Rescue Plan. According to DeLauro, under the American Rescue Plan the Child Tax Credit reached 61 million children, lifted 3.8m children out of poverty, families making over $150K did not qualify for the full credit and it gave no tax cuts to corporations. This new deal gives a married couple making $400K the full credit while families with no income get nothing, at $2.5K the credit starts fazing in at 15 cents on the dollar. It is estimated that only 400,000 children will be lifted out of poverty but the poorest of the poor children will not get the full credit. Corporate interests get $600B in tax cuts. Democratic reps Pocan and Moore get it, Baldwin doesn’t. This is the kind of “bi-partisanship” that makes me want to puke.