No Relief from 565% Payday Loan Interest

Wisconsin one of eight states with no rules capping interest, despite calls for reform.

Alternative solutions

Consumer advocates and payday lenders alike agree on one thing: Consumers sometimes need fast access to small amounts of credit.

“In this sense the payday lenders are correct — they are filling a need. They are giving credit,” said Barbara Sella, associate director of the Wisconsin Catholic Conference, which weighs in on public policy issues of interest to the Church.

But, Sella said, alternative credit solutions from nonprofits or credit unions would be better than payday loans, she said.

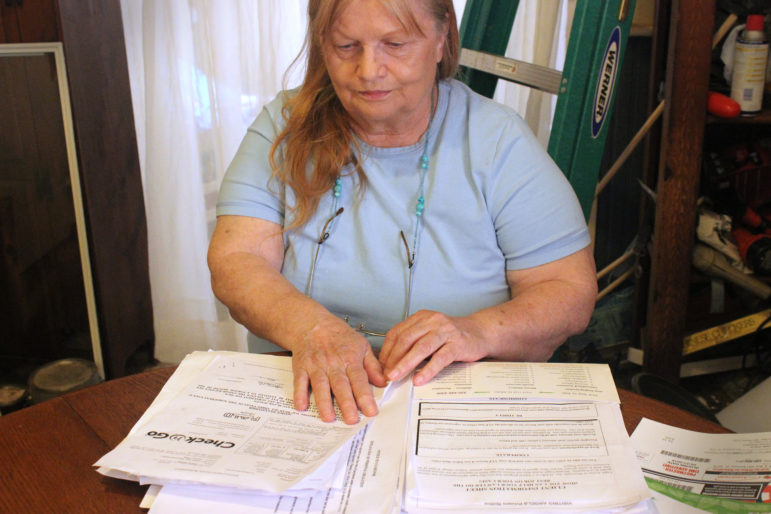

Michelle Warne, 73, examines documents from the Check ‘n Go store in Green Bay. where she borrowed money in 2014 to buy food. “I had no food in the house at all,” she said. “I just couldn’t take any more.” Photo by Bridgit Bowden of Wisconsin Public Radio.

“I think that we could come up with organizations that are not making money off of this and are taking in any profit and reinvesting it to help more people,” Sella said.

For now, Warne said she has no way to pay off her loan. She has made one payment of $101, but has no plans to pay any more on her debt, which with principal, interest and fees will cost her $1,723.

Warne’s only income is a monthly $763 Social Security check.

Warne said she would “never” borrow from a payday lender again, adding, “I wish I would have read the fine print.”

Bridgit Bowden is Wisconsin Public Radio’s Mike Simonson Memorial Investigative Reporting Fellow who is embedded in the Wisconsin Center for Investigative Journalism’s newsroom during her fellowship. The nonprofit Center (www.WisconsinWatch.org) collaborates with Wisconsin Public Radio, Wisconsin Public Television, other news media and the UW-Madison School of Journalism and Mass Communication. All works created, published, posted or disseminated by the Center do not necessarily reflect the views or opinions of UW-Madison or any of its affiliates.

Article Continues - Pages: 1 2

-

Claire Woodall’s Plan to Restore Trust in Milwaukee’s Election Process

Apr 8th, 2024 by Alexander Shur

Apr 8th, 2024 by Alexander Shur

-

Wisconsin’s Medicaid Postpartum Protection Lags Most States

Feb 27th, 2024 by Rachel Hale

Feb 27th, 2024 by Rachel Hale

-

Wisconsin Has A “Smart Growth” Law To Encourage Housing, But No One Is Enforcing It

Dec 22nd, 2023 by Jonmaesha Beltran

Dec 22nd, 2023 by Jonmaesha Beltran

Great article Bridgit Bowden

Financial leeches like payday loan stores exist in our society simply because of the new age class status referred to as “The Working Poor.”

Its simple to explain and understand but if one has escaped or never worked 40 hours and more a week for poverty wages might not understand why a hard working individual would result to borrowing money set at astronomical interest rates.

But our elected Wisconsin legislators – Democrats and Republican – are presumed by their commoner constituent that elect them into political office’s to be the smartest and brightest of individuals among us to legislate and pass laws that protect and ensure fair business practice between the working class “commoners” consumers and big businesses in the state,

With that ^^^ being said, can someone here explain why Wisconsin is one of a few states in the nation that permit “financial leech companies” like Payday Loan Stores,” to conduct loan shark business in the State of Wisconsin?