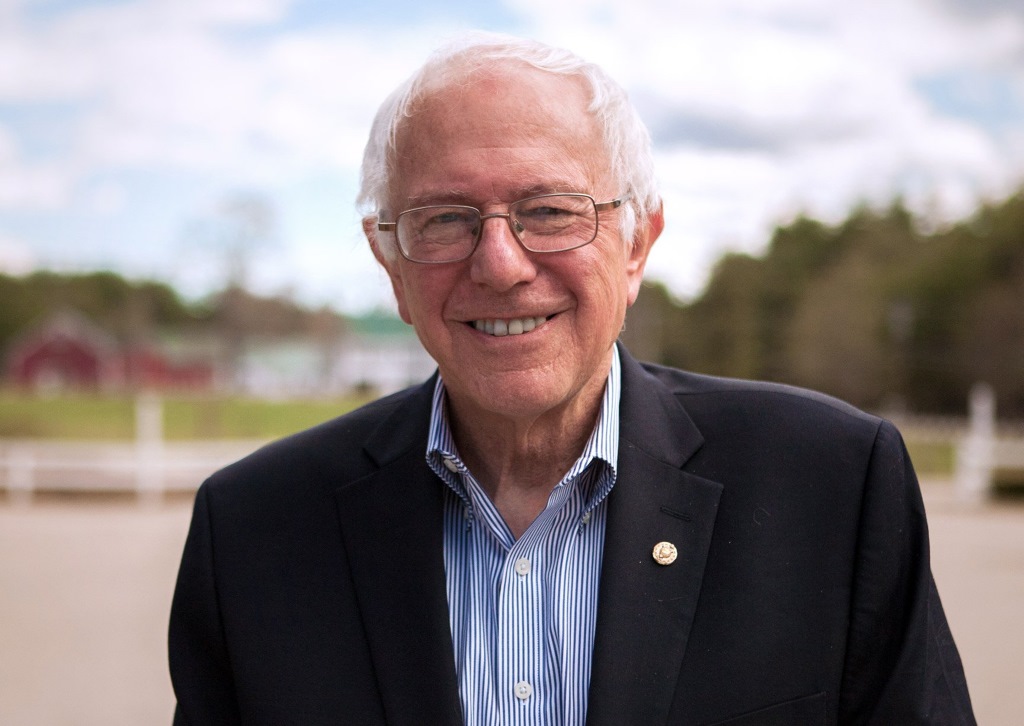

Bernie Sanders, Russ Feingold Put Student Debt, College Affordability at Forefront

More Than 515,000 Would Benefit from Refinance Plan

MADISON, Wis. — Wisconsin has a $19 billion student loan crisis affecting the nearly one million student loan borrowers and their families. Today in Madison and Green Bay, Sen. Bernie Sanders and Russ Feingold laid out the Democratic vision to reduce student loan debt and for college affordability. Front and center in this vision is a call to allow borrowers to be able to refinance their student loans like you can with a mortgage, a plan rejected by Republicans in Washington, DC, as well as Gov. Scott Walker and the Wisconsin legislative Republicans.

“There is no issue with a starker contrast between the two parties than on student loan debt,” said Scot Ross, One a Wisconsin Now Executive a Director. “Democrats want student loan reform and college affordability and Republicans want to starve education and don’t care one bit about students having multiple decade debt sentences.”

In other public comments, Sen. Johnson has displayed a stunning lack understanding and empathy for the real life impacts of the $1.3 trillion student loan debt crisis. He consistently says that the federal government should not be involved in helping students with low interest loans or other means to help fund students’ higher education and declared that more private for-profit colleges would somehow help resolve a student loan debt crisis. The multi-millionaire Sen. Johnson has even pointed to students themselves as causes of the crises of student loan debt and college affordability, based on his experience in the mid-1970s, when his $663 tuition at the University of Minnesota was 1,700 percent lower than it is today.

Perhaps most laughable were Johnson’s comments complaining about a “19th century model of education” after himself offering recently that, “If you wanna teach the Civil War across the country, are you better having tens of thousands of history teachers who kinda know the subject, or would you be better off popping in 14 hours of Ken Burns’ Civil War tape…”

Ross concluded, “While Hillary Clinton and Russ Feingold want student loan borrowers to be able to refinance their loans like you can a mortgage, Donald Trump and Ron Johnson want more predatory for-profit colleges and more scams like Trump University.”

One Wisconsin Now is a statewide communications network specializing in effective earned media and online organizing to advance progressive leadership and values.

NOTE: This press release was submitted to Urban Milwaukee and was not written by an Urban Milwaukee writer. It has not been verified for its accuracy or completeness.

Mentioned in This Press Release

Recent Press Releases by One Wisconsin Now

Dan Kelly’s Opinion: It’s OK to Lie in Judicial Campaigns

Jan 30th, 2020 by One Wisconsin NowState Supreme Court Candidate Co-Authored Column Opposing Efforts to Clean Up Court Campaigns

Campaign Cash Keeps Flowing to WILL’s Shill Dan Kelly

Jan 16th, 2020 by One Wisconsin NowOver $14,000 from Board Members of Right-Wing Legal Group to State Court Justice’s Campaign

Right-Wing Group That Wants to Criminalize Abortion Backs Dan Kelly State Supreme Court Campaign

Jan 15th, 2020 by One Wisconsin NowDan Kelly Supporters Want Court Action to Allow Enforcement of Abortion Ban Dating to 19th Century