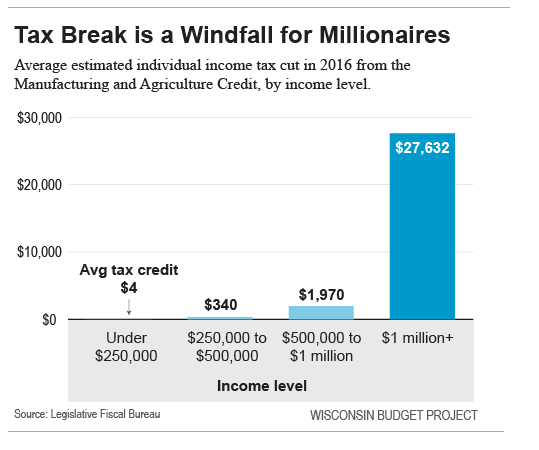

Tax Cut A Windfall for Millionaires

78% of 2011 Manufacturing and Agriculture Tax Credit goes to millionaires, new study shows.

A new tax break that has cost much more than originally anticipated has resulted in enormous tax breaks for the very wealthiest, according to a new report from the Wisconsin Budget Project.

The Manufacturing and Agriculture Credit nearly wipes out state income tax liability for manufacturers and agricultural producers in Wisconsin, with most of the money winding up in the pockets of millionaires. Tax filers with incomes of $1 million and more – a group that makes up just 0.2% of all filers – claim a remarkable 78% of the credit amount that is paid through the individual income tax. Filers in that income group receive an average estimated tax break of nearly $28,000. That stands in sharp contrast to the average tax cut for filers with incomes of under $250,000: just $4.

Other than millionaires, few people in Wisconsin get any value from this tax break. Among filers with incomes of $1 million and more, 1 out of every 4 tax filers receives the credit. But for filers with incomes of under $250,000 – a group that makes up 98% of Wisconsin tax filers – only 1 out of every 450 filers receives the credit.

There are other problems with the Manufacturing and Agriculture Credit. In addition to being extraordinarily slanted in favor of the highest earners, the credit now looks like it will cost more than twice the original estimate, ballooning to $284 million in fiscal year 2017. The unexpectedly high cost means that manufacturers have gotten a much bigger tax break than lawmakers originally thought, and the reduction to state tax revenue is much larger as well.

There is no requirement that manufacturers create jobs in order to be eligible to receive this credit. In fact, manufacturers that lay off workers, move jobs overseas, and close facilities are still eligible for the credit as long as they maintain some manufacturing in Wisconsin.

The Manufacturing and Agriculture credit is the latest example of a counter-productive tax-cutting agenda in Wisconsin. The focus on cutting taxes has done little to boost job creation, but has reduced the resources needed to make the kind of public investments that make Wisconsin a great place to live, work, and do business. Wisconsin’s cuts in state support to public schools are among the largest in the country, endangering the strong public education system that gives Wisconsin students one of the best educations in the country. Wisconsin has also made deep cuts to the University of Wisconsin System, making it harder for universities to add classes in high-demand fields, and for students to graduate on time. Instead of investing in our schools and higher education system, Wisconsin has prioritized tax cuts like the Manufacturing and Agriculture credit, which gives significant tax breaks to millionaires without requiring that even a single new job be created.

Wisconsin Budget

-

Charting The Racial Disparities In State’s Prisons

Nov 28th, 2021 by Tamarine Cornelius

Nov 28th, 2021 by Tamarine Cornelius

-

State’s $1 Billion Tax Cut Leaves Out 49% of Taxpayers

Sep 21st, 2021 by Tamarine Cornelius

Sep 21st, 2021 by Tamarine Cornelius

-

TANF Program Serves a Fraction of Poor Families

Aug 30th, 2021 by Jon Peacock

Aug 30th, 2021 by Jon Peacock

The Walker & GOP-led Legislature are merely fulfilling their Big Agenda (and rewarding their Big Donors). Their goals include paving the way for a Gilded Age in Wisconsin. Walker pal Diane Henderson, the richest person in Wisconsin, pays no state tax. Yet other taxpayers are fooled by hearing of “tax cuts for all.”

By the time the full negative impacts are felt and documented, Walker and many cronies will find ways to move on to even greener pastures.

Other blue states such as New York and California have similar measures in their budgets to keep Manufacturing and AG in their states. Second, is asking teachers to pay their fair share in regards to part of their pension and a small part of their health insurance such a hardship. You call this cuts to education. Third, Walker has spent more on road infrastructure and Badger care than any year under Democratic, hack Jim Doyle.

Jason (post 2), NY State has nothing similar for agriculture, no income tax breaks at all for existing manufacturers that aren’t expanding or relocating, and no permanent or blanket income tax breaks for any manufacturers.

NY does offer a temporary (10 year) tax exemption for certain new, relocating, or expanding manufactures provided they team with a state college or university. This tax break is aimed at hi-tech businesses which includes a small subset of manufacturers. And, again, this tax break expires after 10 years (unlike Wisconsin’s permanent tax credit).