Why Miller Park’s Tax Never Ends

Perhaps because the stadium’s public board cares more about the team than taxpayers.

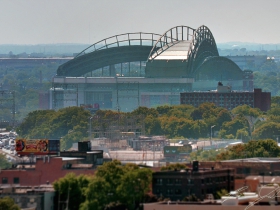

It’s the opening of another baseball season, and Miller Park, with its distinctive retractable roof, has helped make games in this chilly spring very comfortable. But the price tag for taxpayers is considerable. The five-county sales tax paying for the stadium and its never ending maintenance and fancy improvements was originally supposed to sunset in 2010, but the date keep getting moved back. The latest projections are that the tax will end no later than 2020.

Why did it go so much longer — and cost so much more in taxes — than originally projected?

From the beginning the public board set up to oversee Miller Park was a jury-rigged operation meant to go over the heads of local taxpayers. The five-county sales tax hadn’t been approved by local officials of those counties or by its taxpayers. It had been imposed by a majority vote of legislators, most of whom didn’t represent those five counties.

The 13-member board of the Southeast Wisconsin Professional Baseball Park District includes six members appointed by the governor, two by the Milwaukee County, and one each by Waukesha, Washington, Ozaukee and Racine counties and the City of Milwaukee. The crafty thing about this structure is the power is so disbursed that any objections by citizenry to the continuing tax are largely irrelevant. For years, Racine-area politicians have complained about the tax, but with just one vote on the board, they can easily be ignored.

The board members, all unpaid, are supposed to represent their particular government, but for the six members appointed by the governor, there is really nothing at stake financially: the tax has no impact on the state budget. The other seven members undoubtedly care about the tax impact on the county (or city) they represent, but they also have to worry about keeping the Brewers happy: they don’t want to be the board that lost the state its professional baseball team. And other than the one representative from Racine, it’s likely the other 12 members hear far more from the Brewers and their needs than from any taxpayers. And so, what has happened over time is that the board and their executive director, Mike Duckett (a half-time paid consultant), inevitably make agreements increasing what the tax pays for.

Milwaukee Magazine’s Matt Hrodey did a 2014 story tabulating the huge list of stadium improvements financed by taxpayers in recent years, including “floor insulation for the stadium’s administrative offices (about $39,900), new carpeting on the specially ticketed Club Level ($268,600), an LED ‘ribbon board’ encircling the seating bowl ($3.1 million), a high-definition scoreboard ($5.9 million), new flooring for the dugouts ($84,700), retractable windows on the sweltering Terrace Level ($234,200) and a replacement ‘matrix board’ for a billboard facing Interstate 94 ($484,800).”

Early on there were disputes about the Segregated Reserve Fund, to which both the team and board contribute to pay for stadium maintenance, over whether it paid for major breakdowns or normal wear and tear. As Hrodey reports: “Duckett says the district ‘thought we were going to argue forever over what’s routine maintenance and a major capital repair,’ so the two sides reached a compromise, albeit one that favors the Brewers.”

The result: Duckett and the board in 2001 agreed to revise the original lease, signed with the Brewers in 1996, to increase the district’s yearly Segregated Reserve Fund contribution from $700,000 to about $1.75 million. Over the 40 year life of the stadium, which Duckett says is the goal, that’s an increase of $42 million in the costs for taxpayers — all quietly approved without their knowing.

Duckett tells me the $1.75 million annual payment will over time increase, to a maximum of $2.2 million by 2030, further increasing the taxpayer costs. He claims an increase was required by the original lease agreement of 1996, a “40 or 50 page document,” he notes. As it happens, a copy of the lease is not among the documents available to be viewed at the stadium board’s website.

And that’s just money for the smaller costs. What if the retractable roof falls apart? The roof panels are each powered by a 60-horsepower engine, or “bogey,” that moves along a semi-circular rail system; at the end of the 2006 season, the bogie system was replaced at a cost of over $13 million. The Mitsubishi company, which built the roof, paid for this, in response to a suit by the board. But who will buy new bogeys the next time they are needed? The taxpayers.

With this in mind, in March the stadium board approved a “master plan” that projects the sales tax will end sometime between 2018 and 2020 and most likely in 2019. The tax must keep going until it pays for all estimated costs until 2040 for the annual segregated reserve fund, plus estimated additional costs that may arise for various capital costs. The money is in three different pots and totals $52 million, Duckett says.

Why are taxpayers being asked to pay for future costs that may never arise? Simple. If the board doesn’t have the money to pay for a new bogey, in say, 2029, it would have to go back to the five counties and ask for more money. Fat chance of Racine saying yes, which would make it harder for any other county to approve the spending. So instead the sales tax will simply continue collecting money from us. If by 2040 it turns out the entire $52 million isn’t needed, the remainder will be split up by the five counties.

Call me a cynic, but I’m confident the Brewers will find ways to spend the entire $52 million through various requests for upgrades.

As of Dec. 31, 2014 the total cost to taxpayers was $524 million (and that doesn’t include at least a half-billion dollars in local, state and federal tax exemptions), but the total bill will undoubtedly rise higher as a result of the master plan that’s been approved. Precisely how much in additional taxes this involves has so far not been revealed to taxpayers. The important thing is to keep the Brewers happy.

Miller Park

More about the Miller Park Stadium Tax

- Governor Signs Brewers Subsidy Agreement At American Family Field - Evan Casey - Dec 5th, 2023

- Gov. Evers Signs Bills to Keep Milwaukee Brewers, Major League Baseball in Wisconsin Through 2050 - Gov. Tony Evers - Dec 5th, 2023

- Council, Mayor Bickered On Brewers Deal - Jeramey Jannene - Nov 29th, 2023

- Brewers Stadium Deal Passes the Legislature - Shawn Johnson - Nov 14th, 2023

- County Executive David Crowley’s Statement on Bipartisan Bill to Keep Brewers in Milwaukee - County Executive David Crowley - Nov 14th, 2023

- Gov. Evers to Sign Bipartisan Plan to Keep Milwaukee Brewers, Major League Baseball in Wisconsin Through 2050 - Gov. Tony Evers - Nov 14th, 2023

- A swing, a miss, and an errant bat in the stands - State Sen. Chris Larson - Nov 14th, 2023

- Supervisor Burgelis Responds to State Senate Vote on Brewers Stadium Funding - Sup. Peter Burgelis - Nov 14th, 2023

- Murphy’s Law: Civic Blackmail Works For Brewers Again - Bruce Murphy - Nov 14th, 2023

- Senator Agard Statement: Legislation to Keep the Milwaukee Brewers in Wisconsin Passes State Senate - State Sen. Melissa Agard, Senate Democratic Leader - Nov 14th, 2023

Read more about Miller Park Stadium Tax here

Murphy's Law

-

Is Legislature Biased Against Working Class?

Apr 4th, 2024 by Bruce Murphy

Apr 4th, 2024 by Bruce Murphy

-

Associated Press Will Decline in Wisconsin

Mar 27th, 2024 by Bruce Murphy

Mar 27th, 2024 by Bruce Murphy

-

City Attorney Race Is Vitally Important

Mar 25th, 2024 by Bruce Murphy

Mar 25th, 2024 by Bruce Murphy

So, bottom line, it’s a billion dollar project so far. And just under a billion for the Bucks. Pretty soon we’re looking at real money. Time to cut teacher pay!!

Unelected taxing authorities seem to have this issue. So why do we keep creating and perpetuating them?

“And so, what has happened over time is that the board and their executive director, Mike Duckett (a half-time paid consultant), inevitably make agreements increasing what the tax pays for.”

Bruce, any idea what Duckett gets paid as a “half-time consultant”?

This should give taxpayers pause about what might be in the pending Bucks Arena lease. Except no one will have any say about that lease except Scott Neitzel, Wisconsin’s Secretary of Admin Services. Will the Wisconsin Center District board have the power to continue drawing on the hospitality taxes it will start collecting whenever they sunset for WCD construction costs?

These rollover taxes are a great way to raise taxes invisibly–and to keep public money from actually supporting truly public infrastructure instead of payoffs to teams that use threats to leave to get whatever they demand.

Any public official, Democrat or Republican that votes for welfare for the Bucks or Brewers should be defeated at the next election. It is an absolute scandal that they continue to impose the costs of operating these businesses on the public when the owners have more money than anyone can possibly imagine. It is a disgrace.

“In 2009, the phrase “taxation without representation” was also used in the Tea Party protests, where protesters were upset over increased government spending and taxes, and specifically regarding a growing concern amongst the group that the U.S. government is increasingly relying upon a form of taxation without representation through increased regulatory levies and fees which are allegedly passed via unelected government employees who have no direct responsibility to voters and cannot be held accountable by the public through elections.”

I’m with you “T”. Half the citizens of this city are too poor to attend a game in a stadium they continue to pay for. Thanks, Bruce.

T, we just had an election and the Bucks subsidies were not raised as an issue in nearly any race (except occasionally in Abele’s, which seemed to matter little).

Also, as noted, with Miller Park there are no longer any elected officials involved in this taxing scheme. Taxpayers have been outfoxed and virtually silenced. Sure, someone could go after a “half-time consultant” and District board members but how and with what clout? Bruce Murphy and Matt Hrodey write about these issues periodically but without any elected reps to hold accountable what’s the public to do?

The few state legislators who voted against the Bucks Arena deal (trying to get naming rights to repay some of the $400 million taxpayers will cover) have been warned that their looking out for taxpayers will be raised as an issue in their fall re-elections. It’s a topsy-turvy world.

I remember the same year they started building this they were cutting wheat subsidies to grade schools.

I knew people that actually left the city and the county when the stadium deal went through, it was a tax lining the pockets of the rich back then, and there doing it again with the Bucks…

Look at any city around Milwaukee’s metro size and see if those cities are supporting two professional sports teams, a couple of minor league teams, an art museum, a regular museum, an extensive library system, opera, rep theater; I can go on. The answer is “no” because the income and tax base can’t support it.

I remember the Milwaukee Journal/Sentinel publishing articles proving that there was no great economic impact generated by having the Brewers in Milwaukee, and we could easily afford to let them go. The scuttlebutt I got was the Milwaukee Journal/Sentinel people were quietly called on the carpet by the Greater Milwaukee Committee and those stories disappeared from the paper.

Andy is correct, at least in terms of sports teams. If you look at ranked lists of city size, or metro area size, and see which cities and metro areas surround Milwaukee’s, none of them have two pro sports teams. I don’t know about the museum, etc. (which adds much more to the city anyway) – but it’s time to face up: we are not a major-league city in terms of population and resources, and we will be unable to solve our far more pressing problems until we stop paying for the fake prestige of trying to fund teams at the level of metro areas 50-100% larger than ours.

Wait other cities the size of Milwaukee don’t have two sports teams? What about Kansas City? Pittsburgh? Atlanta? Cleveland? All smaller than Milwaukee and all with at least 2 pro sports teams. They all have museums and other cultural amenities as well right?

To be fair Vincent, the numbers can change significantly if you count MSA versus CSA areas.

Either way, with the exception of Atlanta, you are right. Cleveland, Kansas City, Cincinnati, Pittsburgh are all areas of similar metro size, (though it should be noted the city proper of each is around 300,000) that support more than two professional sports franchises and cultural amenities.

This is a classic case of Milwaukee holding itself back. For whatever reason there is a need for some people to dismiss MKE as on the level of Providence or Omaha or Baton Rouge, small and provincial.

The Brewers are reguarly in the top ten of attendance in the major leagues, our market can support two (really three if you count the Packers) professional franchises and big city cultural amenities.

I remember my grandmother’s prediction back when this tax was first proposed. She said never, ever support a new tax, regardless off what it’s for because once “they” get that money coming in, they never wanna give it up.

She was so wise. And this is why all the idiots that supported the taxpayer subsidies for the Bucks arena are idiots, too. We’ll be paying for that foolishness, too, while the rich owners and players laugh all the way to the bank.

And when you adjust for market size, the Brewers have the best attendance in baseball.

A big problem with these subsidies for private ventures, whether sports teams, housing or to lure businesses, is that no one ever required cities and states to account for the subsidies’ returns–until last year. Of course, they can still try to fudge the numbers.

http://www.strongtowns.org/journal/2015/9/15/accounting-for-subsidies

Urban planner Chuck Marohn of Strong Towns has been harping about these issues for years. He’s become one of the most-respected voices about urban issues–and warns that most of what cities are doing is completely unsustainable on a fiscal level. But most still keep doing it, esp. mid-sized and larger cities to keep up with the Joneses/sports arms races.

Strong Towns does not offer easy solutions or formulas (Marohn says there are none). They do focus on what is working in some specific strong towns, and they debunk failing models such as minimum-parking mandates and overnight “entertainment districts” such as we taxpayers are subsidizing for the Bucks in addition to the Arena itself.

Yes, tearing down a completely functional, paid-off parking garage built for $30 million IS a public subsidy. And taxpayers paying $35 million for a new garage and then splitting half of the new income with three billionaires is NOT a sane fiscal policy. To say nothing of destabilizing all the existing hospitality businesses, many of which are likely to struggle when the numbers of bars and restaurants explodes a block or two away. How can a cool architectural design solve that Econ 101 problem?

It’s interesting that Green Bay & Brown County, a much smaller metro area (and home to the only socialist-model sports team) says it’s making sure to protect local businesses from being cannibalized (yes, civic leaders use that word) as they build their new Titletown District. They probably cannot afford to be cavalier and instigate a Darwinian contest among hospitality businesses. Business owners in smaller towns may know each other’s families.

By the time Milwaukee’s civic leaders learn whether their blithe promises prove true that “you cannot have two many bars and restaurants in one place,” they may have retired or gone on to greener pastures.

BTW, has anyone noticed that Las Vegas’s new arena, also designed by Populous, cost $375 million and Milwaukee’s price tag is $500 million? We can only guess what the additional $125 million is funding here. And yet the Bucks prez worries it won’t be enough.

This tax has gone on all too long. You think this is the only time this would happen? Wait until Barrett gets that trolley going since it’s not built yet and he’s already talking of expansion. Tax hell’s like this will never end. And as for the Brewers having those “5 county dates” where county residents can get tickets half price, by now it should be FREE tickets.

I would take it one step further Hal. The Brewers should actually be paying people to attend games. You should show up at Miller Park and get an amount based on your income. $5 if you are from say River Hills and $150 if you are from 53206.

MLB, NBA, NFL – billion dollar enterprises!

Stadium taxes – extortion!

If the leagues were to get their funding from business sources, they would be paying interest or a percentage of their revenue. Why should it be different when the tax payer is the funding source?

The closest comparison to how all this sports extortion works is how the Mafia operates with paying “tribute.” The sports leagues are the big guys in town and everyone goes along out of fear of what will happen if they do not.

And the fans become addicted to their sports fixes, so no one is going to complain that the elected officials, the middle men, are collecting money to pay off the dons.

Others say it’s like religion. In any case, it’s not a rational thing. It may take decades or generations before anyone get courageous and succeeds in countering extortion with sanity.

I had no idea being a devoted Brewers fan makes me an irrational sports addict. Can we set sanctimony aside for a minute here? Is there no downside to losing the Brewers? Does Milwaukee suddenly become a utopia because instantly there’s bundles of cash going to schools and museums? I get being upset by the arena deal and the Miller Park tax and feeling like we are being way too generous to wealthy owners. I’m really ambivalent about the arena deal. But I also think real damage could be done if the city were to lose a professional sports team or two. Damage to morale and identity and economic damage as well since the teams do a lot of good work through community foundations and such. I think losing the Brewers would be a terrible thing for a baseball town like Milwaukee.

what were once vices are now habits, Doobie Brother.

Miller park is one of the few stadiums or arena’s I’ve seen that has demonstrated real positive economic impact far above any public subsidies it receives. That doesn’t include charity involvement or intangibles such as city morale/pride, business recruiting, free marketing, etc.

http://www.jsonline.com/news/milwaukee/new-study-distant-brewers-fans-have-263-million-annual-economic-impact-vm94jgd-197535861.html

Bruce,

I always tell people: if you want real news from a fairly objective journalist, head to Urban Milwaukee and read your articles. Keep up the great work!

Vincent Hanna,

To clarify, I was not calling out all of us sports fans for enjoying the games. It’s more that our fandom (and their being cartels) is being used to extort politicians and exploit taxpayers. I’ve loved attending baseball games since childhood. I just hate that the public gets played–and that there’s rarely a real pro negotiating on behalf of taxpayers to prevent horrible fleecing.

The exception that proves the rule is that state administrator Scott Neitzel hired a pro to help negotiate the Bucks lease. This week they announced a lease with some teeth in it. But experts on sports deals did not consider the Bucks funding deal a good one for taxpayers. And the awful deal to secure Miller Park inspired the writing of the book “Field of Schemes.”

Politicians could have jointly hired a pro to have looked out for taxpayers. Instead, hubris won out and they insisted on all going it alone against the Bucks’ teams of experienced sports-deal negotiators. Then it was a case of divide and conquer. All that pols could brag about was what Bruce called “hiding” the tax burden. For example, we will only start paying off the Wisconsin Center District borrowing of $73 million in about 13 years through a half-cent food-and-bev tax.

Meanwhile we’re taxed way too high and still can’t fund basic services.

Would someone please explain to me how it can be legal that the Brewers can still get the extra 5 county tax? It was written all over the place that it would expire in 13 years.